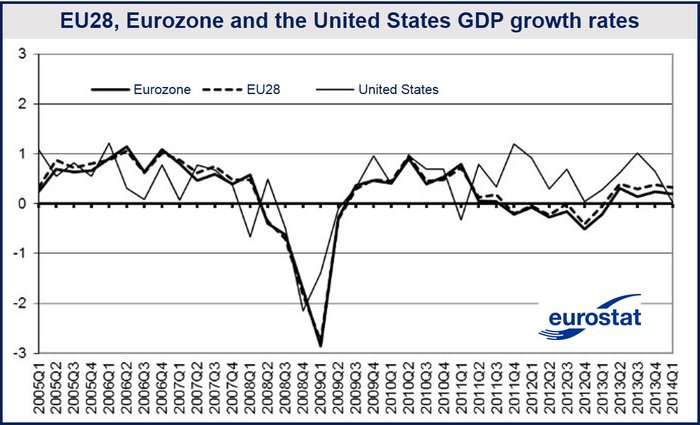

Eurozone growth slowed down in the first quarter of 2014, according to Eurostat, the EU’s statistical agency. Gross domestic product (GDP) grew by 0.2% during the first three months of this year in the Eurozone and by 0.3% in the EU28 (the whole of the European Union). In Q4 2013, GDP had expanded by 0.2% in the Eurozone and 0.4% in the EU28.

Compared to Q1 2013, GDP in the Eurozone grew by 0.9% in Q1 2014 and by 1.4% in the EU28, after +0.5% and +1.0% respectively in the previous quarter.

Eurozone cannot blame the weather

The United States also had a very sluggish first quarter, growing only by 0.1% compared to Q4 2013. Compared to Q1 2013, first quarter GDP grew by 2.3% in the US, says Eurostat.

However, while the US slowdown was caused by abnormally harsh winter conditions, the EU had an extremely mild winter.

Among the larger economies in EU28, Germany and the UK reported strong Q1 2014 GDP growth, while France and Italy disappointed.

(Source: Eurostat)

German GDP grew by 0.8% in the first quarter compared to the previous quarter, as did the UK’s (the UK is not a Eurozone member, it opted to keep the pound sterling). Spain’s economy expanded by 0.4%.

France registered zero percent growth, while Italy’s economy shrank by 0.1% in Q1 2014. The economies of the Netherlands, Portugal and Estonia also contracted.

What will the European Central Bank do?

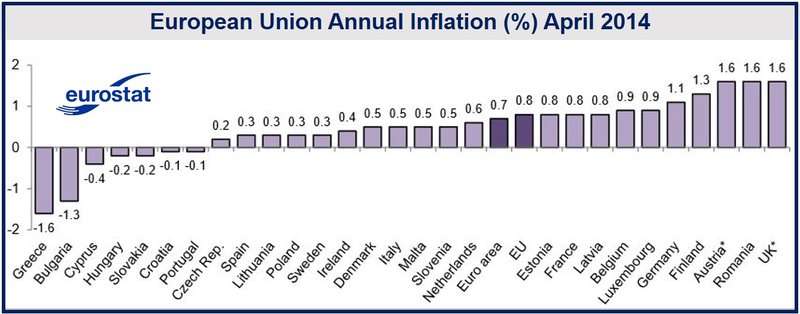

The European Central Bank (ECB), along with scores of economists around the world, has been concerned with the Eurozone’s sluggish growth rate, very high and persistent unemployment, and extremely low inflation. In March annual inflation stood at 0.5%, and increased slightly to 0.7% in April, which is still way below its target of 2%.

Several EU28 countries are beginning to report declining prices, and not all of them in the “periphery” (southern European nations).

(Source: Eurostat)

Unemployment in the EU in March fell by just 22,000 compared to February and by 316,000 versus March 2013, a small figure considering there are still 18.913 million jobless people seeking work.

Now with the sluggish Q1 2014 GDP figures, there is serious concern that the Eurozone may slide into deflation and then a recession.

In an interview with the BBC, Chris Williamson, an economist at Markit, said “Although the economy has now grown for four consecutive quarters, the pace has failed to accelerate to anything other than lacklustre over this period. The data therefore add to the likelihood of the ECB taking action at its June meeting to inject more stimulus into the economy.”

Spain’s 0.4% GDP growth was not strong enough to bring down the unemployment rate, which increased to 35.93% in Q1 compared to 25.73% in the previous quarter. France’s and Italy’s weakening performance will only add to jobless rates which are already in double figures.

The New York Times quoted ING economist Carsten Brzeski who said “(the ECB) would not be unhappy with some downward revisions to growth and inflation (as a means of justifying more aggressive monetary policy).” Without clear signs of an economic rebound, Brzeski believes the ECB will most certainly have to take steps to boost the economy when it meets next month.