If you are looking for financial assistance for your business, perhaps to expand it or even launch a new one, you are probably thinking about applying for a Business Loan.

Business loans provide the capital necessary to support various business activities. They help entrepreneurs manage costs associated with running and growing their operations, including purchasing equipment, covering payroll, acquiring real estate, and more.

However, before applying for a business loan, it’s essential to understand the various types of loans available, their requirements, and how they work.

According to Johnson & Wales University, a small business loan is designed to provide funding for business operations. It can either be issued as a lump sum or as a line of credit, which can be used to cover expenses such as inventory, materials, and other necessary purchases.

What Is a Business Loan?

A business loan is an agreement in which a business borrows money from a lender and agrees to repay it over time, typically with interest.

The main idea behind business loans is to provide companies with the funds they need to sustain or expand their operations.

Loans are usually structured as lump-sum payments or as lines of credit that businesses can draw from as needed. Depending on the loan, repayment schedules may require daily, weekly, or monthly payments. In most cases, repayments are done monthly.

Business loans are divided into two primary categories: secured and unsecured loans.

Secured Loans

Secured loans require businesses to offer collateral, such as real estate, equipment, or other assets, which the lender can claim if the loan is not repaid.

Unsecured Loans

Unsecured loans, on the other hand, do not require collateral but may have stricter terms and higher interest rates.

Types of Business Loans

There are several different types of business loans, each designed to meet specific business needs. Knowing which type is best suited for your situation is crucial before applying for financing.

Term Loans

In the world of business, this is the most common type of loan. Businesses receive a lump sum of money upfront and repay it over a set period, typically with fixed monthly payments.

Term loans can be short-term, with repayment periods ranging from three months to two years, or long-term, with periods extending up to 10 years.

The loan amount and interest rates depend on the creditworthiness of the business and its owner.

SBA Loans

The Small Business Administration (SBA), a US government agency, offers government-backed loans to help small businesses secure financing.

While the SBA does not provide the loan directly, it guarantees a portion of the loan made by private lenders, reducing the lender’s risk.

SBA loans typically offer favorable terms and lower interest rates but can involve a more lengthy and detailed application process.

The SBA offers various loan programs, including the popular 7(a) loan program, which provides funding for working capital, equipment, and real estate purchases.

Line of Credit

A business line of credit functions much like a credit card. The business is approved for a certain credit limit and can draw from it as needed, paying interest only on the amount borrowed.

This type of loan is particularly useful for businesses with fluctuating cash flow, such as seasonal businesses or companies with irregular payment cycles. Repayment terms for this type of credit arrangement typically ranges from 12 to 24 months.

Merchant Cash Advances

A merchant cash advance provides businesses with a lump sum of cash in exchange for a portion of their future sales.

Repayments are made through daily or weekly deductions from the business’s credit card sales.

Merchant cash advances are easier to obtain than traditional loans but they are more expensive; they often come with higher fees and interest rates.

This type of loan is best for businesses that have a high volume of credit card transactions but need quick access to funds.

Equipment Financing

If you need to purchase equipment, such as vehicles, machinery, or computer systems, you should consider equipment financing.

The equipment itself typically serves as collateral for the loan, reducing the risk for the lender. Equipment financing loans tend to have favorable terms, but failure to repay the loan could result in the lender repossessing the equipment.

Invoice Financing

Invoice financing allows businesses to borrow against their outstanding invoices. The lender advances a percentage of the unpaid invoices, and the business repays the loan once the invoices are paid.

You may find this type of loan useful if your business experiences cash flow issues due to late payments from clients. With invoice financing, you can access funds quickly without waiting for clients to settle their invoices.

How to Qualify for a Business Loan

Lenders typically have specific criteria for approving business loans. Understanding these requirements can increase your chances of securing financing.

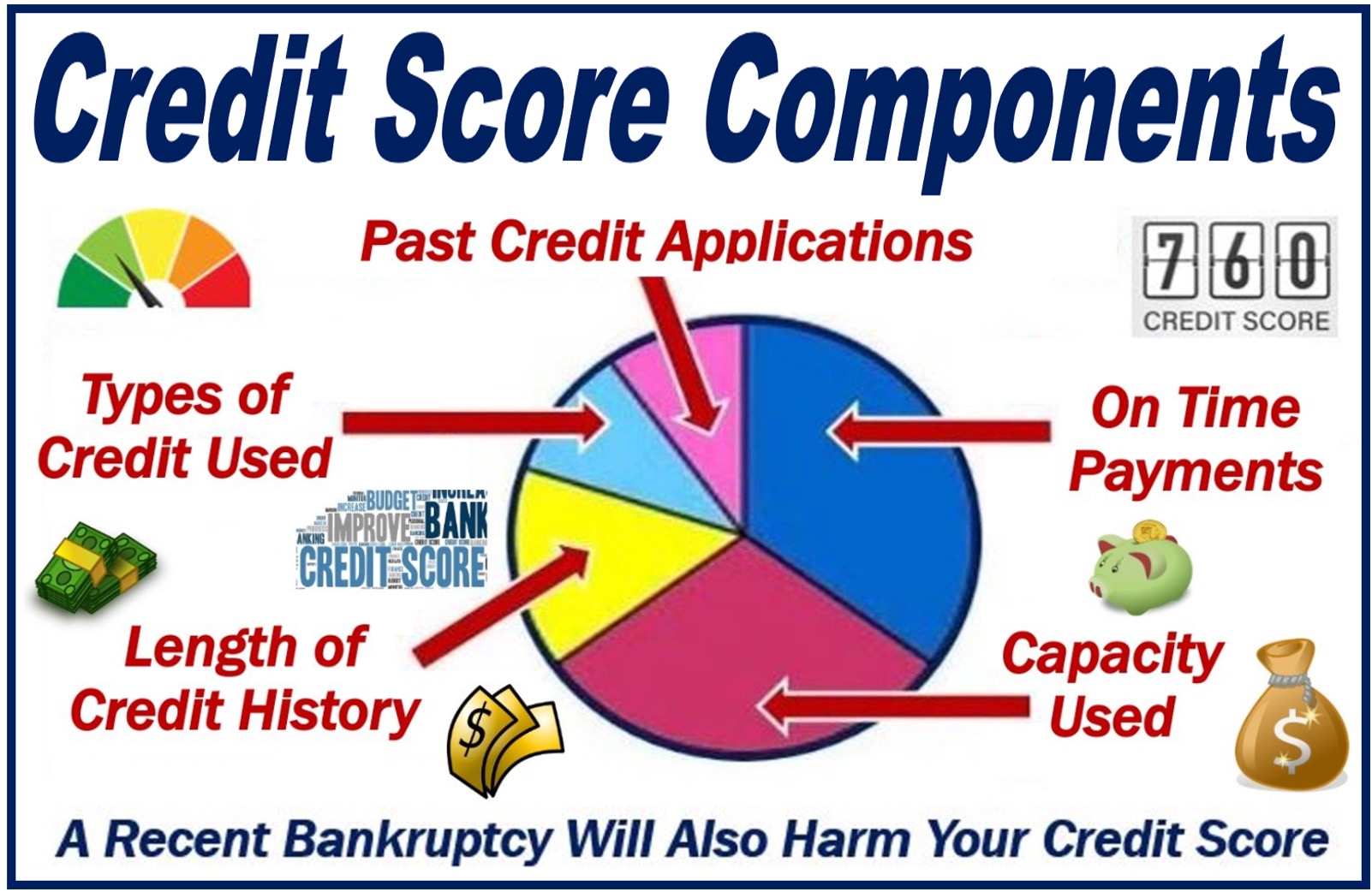

Credit Score

Most lenders will assess both the business’s and the owner’s personal credit scores when evaluating a loan application.

A higher credit score improves the chances of approval and often results in more favorable terms.

Traditional banks may require a credit score of at least 680, while alternative lenders might accept lower scores.

Business Revenue and Financial History

Lenders want to see that the business generates sufficient revenue to repay the loan.

Providing financial statements, such as profit and loss reports, balance sheets, and tax returns, can help demonstrate your business’s ability to manage its finances responsibly.

You are more likely to secure favorable loan terms if you can show that your company has a steady history of revenue and profitability.

Collateral

For secured loans, lenders require collateral to mitigate their risk. Businesses can offer assets such as real estate, equipment, or inventory as security.

The value of the collateral must typically exceed the amount you plan to borrow. If you default – fails to repay the loan – the lender can seize the collateral to recover their losses.

Personal Guarantee

In some cases, the lender may require you, the business owner, to sign a personal guarantee, which makes you personally liable for repaying the loan if your business defaults.

This requirement is more common for unsecured loans or loans to newer businesses without a long credit history.

Preparing to Apply for a Business Loan

Applying for a business loan requires careful preparation. Before submitting your application, gather all the necessary documents to support your case.

Business Plan

A well-prepared business plan includes the company’s goals, strategies, and projected financial performance.

Lenders use the business plan to assess the business’s viability and potential for growth.

Make sure your plan includes detailed information on how the loan will be used and how you plan to generate the revenue needed to repay the loan.

Financial Statements

Most lenders require businesses to provide at least two to three years of financial statements, including tax returns, profit and loss statements, and balance sheets.

These documents provide a snapshot of the business’s financial health and help lenders assess the risk of lending.

Personal Financial Information

If the lender requires a personal guarantee, your personal financial information will also be considered.

This includes personal tax returns, bank statements, and credit reports. Lenders want to ensure that the business owner has sufficient personal resources to cover the loan if there is a default.

Take a Step Back

Before going ahead and signing the loan contract. Take a step back and ask yourself these questions:

- Should I shop around more?

- Have I considered all other financing options?

- Am I happy with the interest rate?

- What are the loan fees and hidden costs?

- Do I really need this loan?

- How will this impact my financial goals?

- Can I comfortably afford the monthly payments?

- What happens if my financial situation changes?

Business Loan Calculator

A business loan can be a critical tool for companies seeking to grow or maintain their operations.

By understanding the different types of loans available and preparing a thorough application, you can improve your chances of securing the financing you need.

Whether you are looking for a traditional term loan, an SBA-backed loan, or an alternative financing option, careful planning and research are essential to finding the right loan for your business.