Hypothecation refers to pledging an asset – granting a hypothetic – such as a house or car, as collateral on a loan. However, the borrower still has ownership of that asset and enjoys its benefits. That ownership continues as long as he or she does not default. People commonly use this type of hypothecation to get a mortgage on a house.

The term is similar in meaning to a lien.

Hypothecation aims to mitigate the lender’s risk. If the debtor is unable to pay, the lender possesses the collateral and can, therefore, claim its ownership. The lender can subsequently sell it and thus recover the money that it lent or at least some of it.

The debtor is the person or entity that owes money.

A hypothetic is the right of the lender or creditor to take a borrower’s asset. Specifically, to take their asset if the debtor cannot repay a debt. However, in the meantime, i.e., while the debtor continues paying back, that asset remains in the borrower’s possession.

According to ft.com/lexicon, hypothecation is:

“The pledging of assets as collateral to secure a loan. Margin agreements with brokers normally involve the hypothecation of securities.”

Hypothecation – home and auto loans

The most common example of hypothecation is a mortgage, i.e., a loan to purchase a house. Under the terms of the loan, technically the borrower owns the house.

However, since the borrower pledged it as collateral, the lender can lawfully seize the house if the borrower defaults. We call this lawful seizure of the house a foreclosure.

Many other types of loans involve hypothecation. For example, when you borrow money to buy a car, i.e., auto financing. You pledge the car as collateral on the loan.

If you fail to make your auto-loan payments, whoever lent you the money can legally repossess the car.

Business loans

Loans for the purchase of business equipment also typically involve hypothecation.

A hypothetic may cover any asset, such as real estate or machinery or office equipment. ‘Hypothetic,’ in most jurisdictions, refers just to movable assets. A lien, on the other hand, is for immovable assets.

In most countries or regions, there is a public registry of hypothetics. Potential lenders or creditors can therefore see whether other lenders or creditors have rights over an asset.

Multiple hypothetics

In most jurisdictions, it is legal to grant more than one hypothetic over a single asset. If the borrower defaults, the rights of the creditors or lenders come in chronological order. In other words, their rights relate to the publications of the hypothetics, i.e., when the publications occurred.

Hypothecation does not apply to unsecured loans. In most cases, credit card loans are unsecured.

If borrowers fail to meet their card repayment obligations, the lender will first refer that account to a collections agency. The lender will eventually sue them in court in an attempt to recover the money.

If there is no hypothecation, the lender or creditor has no legal right to seize the borrower’s assets.

Hypothecation only applies to secured loans.

Hypothecation – investments

Hypothecation exists in investments, such as in margin lending in brokerage accounts.

If an investor decides to buy securities on margin, it has been agreed that those securities may be sold if necessary on a margin call.

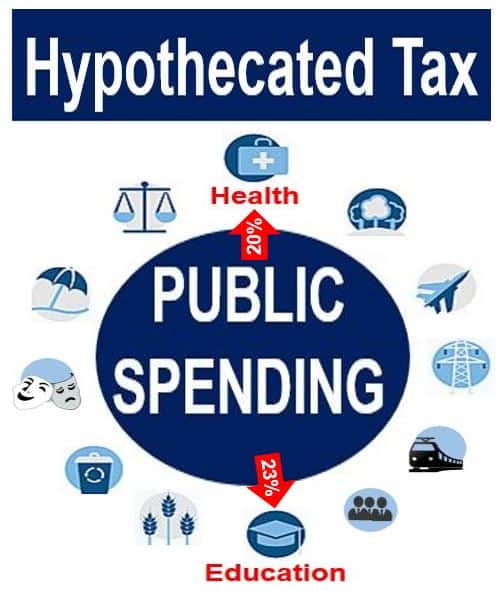

What is hypothecated tax?

Hypothecated tax is a tax that the government earmarks for a specific purpose. To earmark means to put money aside for a specific purpose.

It is often a clever way to overcome public hostility to paying more in taxes. Taxpayers are usually more willing to pay taxes if they know where the money is going. The government may, for example, earmark the tax revenue for health spending or more schools.

The main drawback to making this kind of public-spending pledge is that it ties the government’s hands. This is especially the case if there are other more urgent needs.

Cynical taxpayers say that governments invariably break their pledges. Civil servants, when under pressure from politicians, find ways to move the goalposts, cynics add.

Rehypothecation occurs when the lender re-uses the collateral to secure its own borrowing. This occurs mainly in financial markets.

Etymology of hypothecation

According to the Online Etymology Dictionary, the verb ‘hypothecate’ first emerged in the English language in England in the 1680s. At the time, it meant “pledge (something) without giving up control of it, pawn, mortgage.”

It comes from the word ‘Hypothecat,’ the past-participle from of Medieval Latin ‘Hypothecare,’ which came from Late Latin ‘Hyptheca.’ ‘Hyptheca’ meant ‘a pledge.’

The Latin word came from Greek ‘Hypotheke,’ meaning ‘a pledge, deposit, mortgage.’ The Greek prefix ‘Hypo-‘ means ‘under, beneath,’ while the suffix ‘-tithenai’ means ‘to put, place.’