Insurance is a contract in which a company agrees to provide financial compensation to an individual, property, company, or entity for specified losses. This compensation covers instances of illness, damage, or death. The party receiving this compensation is known as the ‘insured,’ while the ‘insurer’ refers to the company offering this coverage or protection.

Sometimes the insurer is the government. The ultimate aim is always the same – to protect against financial losses and hardship if something unpleasant happens.

A risk-transfer mechanism

It is a risk-transfer mechanism that ensures either partial or full financial compensation if something unpleasant happens.

For example, if I have a car, an unpleasant event could be crashing it and damaging my own vehicle. Damaging another person’s vehicle, or property, and hurting people are also examples of undesirable or unpleasant events.

Causing somebody’s death is the worst possible unpleasant event. As an insured party, I will get money to cover me financially if any of these events happen.

In the contract, the insurer indemnifies the insured against a specified amount of loss that might occur from a specified list and/or description of eventualities over a given period. The insured gets coverage as long as they pay the premium.

A premium is the amount of money that the insured must pay for an insurance policy. They pay the money monthly, quarterly, once, or twice a year.

Life is full of hidden dangers and risks that could happen at any moment. For example, your house could burn down, and somebody might steal your car. You could also get seriously ill and subsequently be out of work for a long time. Fortunately, there is a policy out there to reduce the financial loss should the worst occur.

Reputable websites offer comprehensive guides to help consumers understand and navigate the world of auto insurance, including how to get the best policies, coverage, and rates from the top companies.

Insurance – pooling premiums

The system works by pooling all the premiums of the insured entities. The money subsequently pays for the losses that some of them may incur.

For a premium, the insured entities are protected from risk. The size of the premium depends on the severity and frequency of the event occurring.

For an insurance system to work, i.e., for the insured to get coverage, they must meet certain criteria.

For example, you are unlikely to get life insurance if you are a bullfighter. An alcoholic who smokes sixty cigarettes a day will probably not get life insurance either.

There are insurance policies for virtually any risk. There are also umbrella policies, which provide additional coverage in case the underlying policy is not enough.

Life vs. general insurance

In life insurance, the company pays a specific amount of money when the person dies.

In general insurance, the amount of compensation paid is proportional to the loss incurred by the unpleasant event.

For example, if the contents of my house are insured and there is a flood, causing $10,000 worth of damage, I will be paid $10,000 to either replace or repair the items that were damaged.

If the damage is greater, I receive more (if my cover reaches that amount).

According to the American international banking and financial services holding company Wells Fargo: “Life turns on a dime. One can never predict when insurance will be needed. Many people only purchase it when it’s required, like when they’re buying a new home or car. Paying for insurance now – even if it isn’t required by your state or lender – can be an important safety net if the unexpected happens.”

Let’s suppose John Smith has life insurance that pays out $1 million if he dies. When he dies, there is just one fixed payment, i.e., no more and no less, regardless of how it occurred.

Insuring a household’s primary earner

It makes sense for the primary breadwinner in a household to have life insurance. If he or she dies prematurely, the loss of income would cause significant hardship for the whole family.

It would be either impossible or extremely difficult to replace that income. With life cover, the company pays the lump sum when the person dies, thus replacing the primary breadwinner’s income.

Companies can insure their premises and factory equipment. They can also insure their employees in case of accidents at work, and other tangible losses.

Policies cannot compensate for everything

However, policies will not compensate companies for problems with customer confidence, market share, or continuity of business.

After a disaster, for example, the insurer cannot provide the insured business with skills or knowledge. In other words, it does not provide some resources that are necessary to resume operations.

Common reasons for insurance

There are literally endless eventualities that may cause people, businesses, or other entities significant financial losses. Below is a list of the most common reasons people seek insurance:

Homes, households & families

- Protecting a household after somebody’s death from loss of income.

- Receiving money if you develop a disability.

- Protecting the contents of your home from theft, flood, hurricane, earthquake, and other hazards.

- Protection for the insured and family members against unexpected health expenses.

- A policy to cover the costs of a funeral. This is one of the oldest types of insurance there, dating back to Ancient Greek and Roman times.

- Protecting yourself against legal claims made against you. We call this liability insurance.

- Most homeowner’s policies include liability coverage. It protects the insured in the event of a claim brought by an individual who falls or slips on the property. A doctor would have medical malpractice insurance.

- Covering debt repayments after death.

Vehicles

- Getting cover for losses the policyholder incurs because of car accidents.

- Protecting your vehicle against theft, fire, or flood.

Businesses

- Protecting your business from loss of income or interruption of business.

- Key employee cover, i.e. protecting your business if you lose a key employee.

- Protection from from lawsuits.

- Protecting cargo during a sea voyage – a voyage policy.

Pets

- Covering the cost of veterinary care, surgery, and medications if your pet gets ill.

Insurance – brief history

Ancient history

The industry dates back thousands of years. Babylonian and Chinese traders practiced distributing or transferring risk two and three thousand years BC respectively.

The Babylonians had a system dating back to 1750 BC which covered merchants. If a merchant obtained a loan to fund his shipment, he would pay an additional fee to the lender.

The lender would subsequently cancel the loan if somebody stole the goods or if they fell into the sea.

At some time during the first millennium BC, citizens of Rhodes created the general average. This allowed merchant groups to pay to insure the goods that they were shipping together.

Premiums were collected and used to reimburse any merchant whose products were jettisoned during transport.

Middle ages

Individual contracts – policies not bundled with loans – emerged in Genoa in the fourteenth century AD.

The first insurance contract we know about happened in Genoa in 1347. For the next 100 years, maritime insurance developed and spread rapidly, with varied premiums.

Since 1666

Property insurance as we know it today existed when the Great Fire of London occurred in 1666. The fire destroyed more than 13,000 homes.

After that fire, Londoners began to view property cover as a ‘matter of urgency’ rather than one of convenience.

Sir Christopher Wren (1632-1723), one of England’s most acclaimed architects, included in his new plan for London in 1667 a site for ‘The Insurance Office’.

Several attempts at fire coverage schemes failed until 1681. Economist Nicholas Barbon together with eleven associates established London’s first fire insurance company – the Insurance Office for Houses, at the back of the Royal Exchange. It provided insurance for brick-and-frame homes. The Insurance Office initially insured 5,000 homes.

Additionally, at around the same time, the first schemes for the underwriting of business ventures emerged.

By the end of the 17th century, London had become a major center for trade, with rapidly increasing demand for marine insurance.

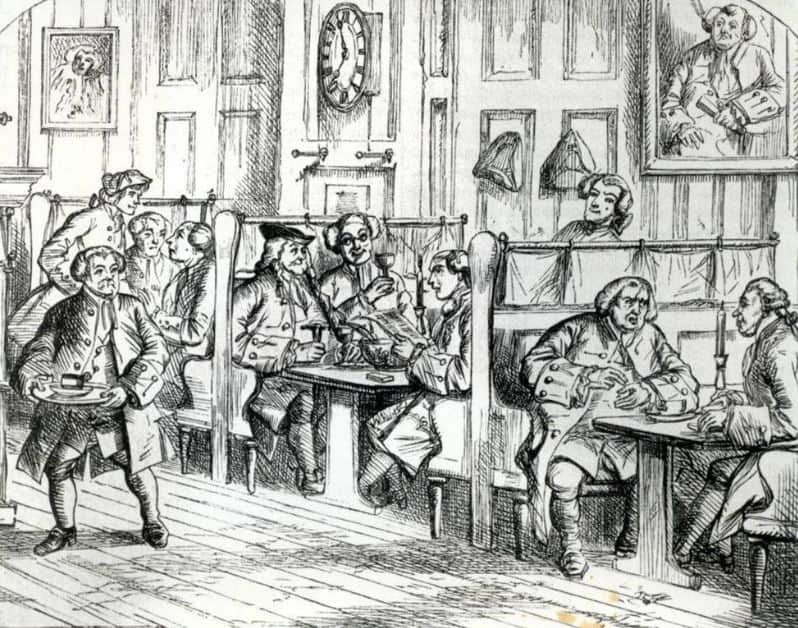

Edward Lloyd opened a coffee house in the late 1680s, where members of the shipping industry began frequenting. Shippers wanted to insure their cargoes and ships.

Individuals willing to underwrite such ventures also needed to insure what they were doing.

Lloyd’s of London

These informal gatherings led to the establishment of Lloyd’s of London, the world-famous insurance market. Several other shipping and insurance businesses also emerged.

The Amicable Society for a Perpetual Assurance Office was the first company to sell life policies. William Talbot and Sir Thomas Allen founded it in 1706.

In 1762, Edward Rowe established the Society for Equitable Assurances of Lives and Survivorship. It was the world’s first mutual insurer.

Mr. Rowe’s company pioneered age-based premiums based on mortality rate. He lay the framework for most calculations made today in the life assurance industry.

Accident insurance

It was not until the late 19th century that ‘accident insurance’ started to become available. It was similar to today’s disability insurance.

The Railway Passengers Assurance Company, formed in 1848 in England, was the first company to offer accident cover.

The nascent railway system, which was growing rapidly, did so with a rising number of fatalities.

In the last quarter of the 19th century, governments started to initiate national insurance programs against old age and sickness.

In the 1880s, Chancellor Otto von Bismarck, from what is today Germany, introduced old age pensions and medical care. He also introduced accident insurance. Subsequently, a type of welfare state was born.

The Liberal government in the UK introduced extensive legislation in the 1911 National Insurance Act. For the first time ever, Britain’s working classes had a contributory system of insurance against unemployment and illness.

Britain’s system was vastly expanded after WWII, forming the first modern welfare state.

“Insurance’s” root word is “insure”

The English root word for “insurance is “insure,” which originates from the Old French term “enseurer.” It later evolved to “assurer” in Modern French, which means “to secure, assure, make sure.”

The prefix “in-” in “insure” is a variant of “en-” in the French word “assurer”. Over time, “insure” came to have its modern meaning of providing or obtaining a financial guarantee against loss, harm, or death.

Below are some derivatives of the English root word “insure,” along with their meanings, and examples of how they can be used in a sentence:

Insure (Verb)

To secure or protect against future loss, damage, or liability.

Example: “It’s important to insure your home against natural disasters.”

Insurer (Noun)

An entity that provides insurance.

Example: “The insurer covered the costs associated with the car accident.”

Insured (Adjective)

Protected or covered by insurance.

Example: “The insured item was replaced by the company after the theft.”

Insured (Noun)

A person or entity covered by an insurance policy.

Example: “As the insured, he filed a claim for the damage to his property.”

Insurable (Adjective)

Capable of being insured or appropriate to be insured.

Example: “The antique collection was deemed insurable by the agency.”

Insurability (Noun)

The quality or condition of being insurable.

Example: “The applicant’s health condition affected her insurability for life insurance.”

Insurance (Noun)

A financial product offering protection against loss or harm in return for payment.

Example: “Her family’s financial stability was ensured through comprehensive life insurance.”

Uninsured (Adjective)

Not covered by insurance.

Example: “The uninsured driver faced significant expenses after the accident.”

Underinsured (Adjective)

Having insufficient insurance coverage.

Example: “Many people find themselves underinsured when major medical emergencies arise.”

Reinsure (Verb)

To insure again by transferring to another insurer a portion of the risk.

Example: “The company decided to reinsure some of its high-value policies to mitigate risk.”

Video explanation