The term Interest Rate may refer to the annual cost of credit or the annual percentage growth of a savings account. It may also be the rates a central bank sets. Specifically, rates against which other banks in the country can lend to each other. When you borrow money from a bank, you will have to pay back the principal plus interest. How much interest depends on the lender’s interest rate. It also depends on how long you take to pay back all the money.

The term ‘principal’ in this context, means the original amount the borrower borrowed, i.e., before adding on the interest.

Banks can determine their own interest rates on loans and savings. However, financial institutions follow the movements of central bank rates closely. Therefore, most bank rates are quite similar.

If you want to borrow money, go to a reputable bank. A reputable bank will charge you a much more reasonable rate than a loan shark. All banks charge higher interest rates on their loans than they pay out to savers. That is how they make a profit.

Usury refers to charging an exorbitant interest rate. In some religions, it is a sin to charge interest on loans, no matter how small. When London-based lender Wonga was charging an APR of 5,853%, the FCA made the company pay redress. The FCA said Wonga was guilty of unfair debt collection practices.

Annual Percentage Rate

Most lenders express interest rate on an annual basis. We call this the APR (annual percentage rate). APR comprises the interest rate plus any arrangement fees that the lender adds to the loan.

Some agreements do not mention interest rates although there is one. We know there is one because the borrower pays back more than the principal. In such cases, we say that there is an implicit interest rate.

In most cases, a low-risk borrower will pay a lower interest rate than a high-risk one.

Interest rate – central banks

The interest rates that borrowers pay and savers receive are closely linked to what the central bank sets.

The US Federal Reserve System (Fed), the Bank of England, and the Bank of Canada, for example, are central banks. The Reserve Bank of Australia, the European Central Bank, and the Bank of Japan are also central banks.

Central banks have several duties, including regulating banks and conducting monetary policy, i.e., controlling the supply of money.

-

Trying to cool the economy

When inflation appears to be increasing, the Fed and other central banks work to reduce the money supply. They do this because they want to halt inflation.

-

Kick-starting the economy

When the economy is waning and unemployment is growing, central banks expand the money supply. They do this because they want to encourage consumers spending and corporate investment.

The control of the money supply occurs through interest rate manipulation by the central bank. In other words, it either raises or reduces interest rates.

Manipulating interest rates does not always work as the central bank had planned. However, for the most part, it is a very effective tool.

When the central bank reduces interest rates, we say it has adopted an ‘easy monetary policy.’

-

Interest rate rise – consequences

After an interest rate rise, business activity and consumer spending decline because credit becomes more expensive.

The stock market also suffers when interest rates go up. It suffers because investors get a better return from bonds or bank deposits, so they shift away from shares.

Interest rate on a loan

When we borrow money, we have to pay back the principal, i.e., the original amount. We also have to pay interest. Imagine that Fred Jones borrows $1,000 from his bank.

Let’s suppose his loan attracts an annual interest rate of 10%. He will have to pay back $1,000 plus $100 (10% interest). Therefore, the total amount Fred will have to pay back after one year is $1,100.

The total amount will be more than $1,100 if Fred borrows the money for longer than one year. Contrastingly, it will be less if he pays it back in less than a year.

Several factors influence interest rate levels, including:

- What the government’s directives are regarding the central bank’s goals.

- Supply and demand in the market.

- Whether the lender perceives the borrower as high-, medium- or low-risk.

- The investment’s term to maturity.

- The currency of the loan.

Terms related to interest rate

- Base Rate: also called the bank rate. It is the annualized rate offered on overnight deposits by the central bank.

- Annual Percentage Rate (APR): used to help consumers compare goods and services with different payment structures on a common basis. Also known as the Annual Equivalent Rate (AER) or Effective Annual Rate (EAR).

- Coupon Rate: for an interest-bearing security, it is the ratio of the annual coupon amount (coupon paid per year) per unit of par value. The current yield, on the other hand, is the ratio of the annual coupon divided by its market price at the moment.

Interest rates through history

Over the past two hundred years, interest rates have varied considerably. Central banks or national governments have set the rates.

-

USA and UK

The Fed’s federal funds rate in the US ranged from 0.25% to 19% between 1954 and 2008. The base rate of the Bank of England varied between 0.5% and 15% between 1989 and 2009.

-

Germany

Germany saw an interest rate nearing 90% in the 1920s. In the 2000s, however, it declined to about 2%.

-

Zimbabwe

The Central Bank of Zimbabwe raised interest rates for borrowing to 800%. Despite this drastic action, its attempt to tackle spiraling hyperinflation failed miserably.

-

Bank of England

The Bank of England has been setting interest rates since 1694. It has one of the world’s most complete economic datasets regarding central bank interest rate manipulation.

Below is a list of some interest rates throughout history (Source: Business Insider):

3000 BC to 200 BC

- 20% in Mesopotamia, c. 3000 BC.

- 20% in Babylon, 1772, BC, according to the Code of Hammurabi, one of the oldest deciphered writings of significant length in the world.

- 40%+ when King Cyrus took Babylon during the Persian conquest, 539 BC.

- 10% Greece, 500 BC.

- 8.33% Rome, 443 BC.

- 8% Athens/Rome during the first two Punic Wars, 300-200 BC.

1 AD to 1810 AD

- 4% Rome, 1 AD.

- 15% Rome, under Diocletian, 300 AD.

- 12.5% Byzantine Empire under Constantine, 325 AD.

- 8% Byzantine Empire, according to Code of Justinian, collections of laws and legal interpretations sponsored by Justinian I, the Byzantine emperor. 528 AD.

- 20% various Italian cities, c. 1150.

- 20% Venice, 1430s.

- 6.25% in Venice when Leonardo da Vinci painted ‘The Last Supper in Milan’, 1490s.

- 8.13% Holland, at the start of the Eighty Years’ War, 1570s.

- 9.92% England, 1700s.

- 7.64% United States, West Florida annexed, 1810s.

20th Century – to date

- 1.85% USA, 1940s, during WWII.

- 15.84%, during President Ronald Reagan’s administration in the 1980s.

- 0-0.25% United States, September 2015.

- 0.25-0.5% United States, December 2015.

Internationally important

All over the world, economists, lawmakers, and businesspeople keep a close eye on interest rates, because of the direct and indirect impact it can have on the economy and their personal lives.

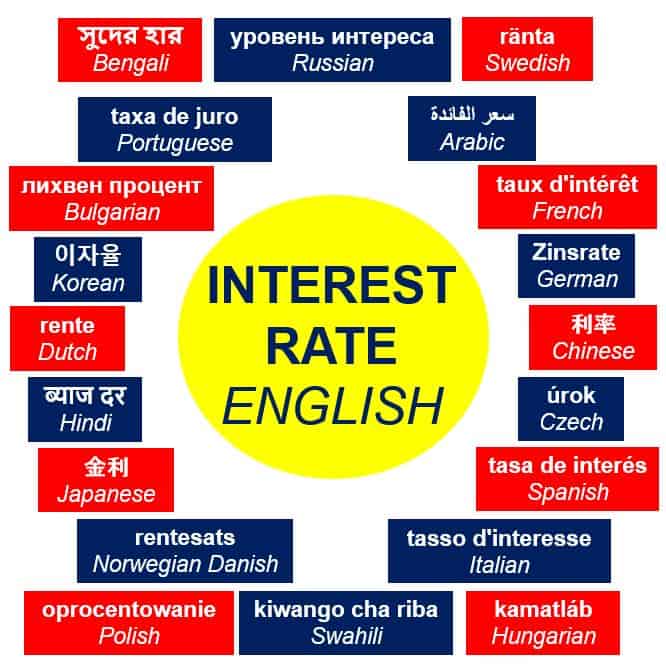

Here is a translation of the term ‘interest rate’ in various languages:

Tasa de interés (Spanish), taux d’intérêt (French), Zinssatz (German), tasso di interesse (Italian), 利率 (Mandarin Chinese), 利率 (Cantonese Chinese, ब्याज दर (Hindi), процентная ставка (Russian), faiz oranı (Turkish), taxa de juros (Portuguese), سعر الفائدة (Arabic), সুদের হার (Bengali), 이자율 (Korean), bunga (Indonesian), and 利率 (Japanese).

Video – What are Interest Rates?

This video was created by Marketing Business Network, our sister channel in YouTube. It explains what the term “Interest Rates” means using easy-to-understand words, phrases, and examples.