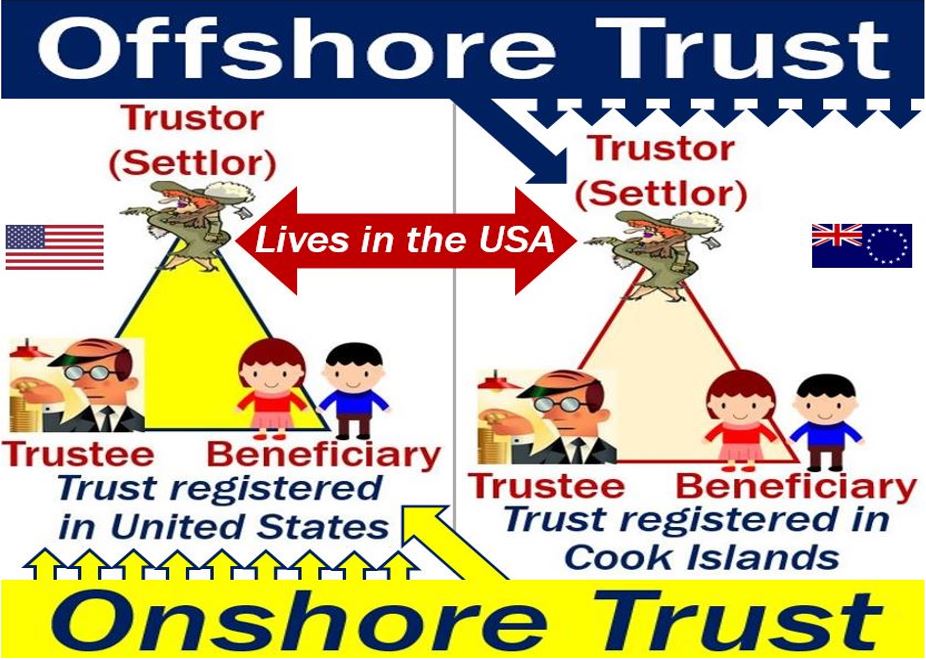

An offshore trust is a trust that a trustor or settlor creates in a jurisdiction that is different from where they live. The trustor, settlor, grantor, or donor is the creator of a trust. An offshore trust is similar in nature and effect to its onshore counterpart.

A trust is an arrangement in which the trustor gives control of their estate to trustees for the benefit of beneficiaries. The trustee is the manager of the trust, while the beneficiary receives the assets, benefits, etc.

For wealthy people and their families, offshore trusts tend to offer better tax advantages. Having a trust in a foreign country, especially a tax haven, offers more privacy. It may also offer protection from court action.

For example, when a local court demands payment, a trust company in the Cook Islands does not have to comply with this order. It does not have to comply because the Cook Islands are outside the local court’s jurisdiction.

Trust and offshore trust – main difference

Offshore trusts are very similar to traditional trusts. They comprise an arrangement or relationship among trustees, settlors, and beneficiaries.

The offshore trust can hold title to property and assets, and manage those assets according to the trust deed. It thus provides a series of distributions and benefits to an individual or group of people. We call those people, i.e., the receivers of the benefits, ‘beneficiaries.’

Offshore trusts differ in that they do not have to comply when a judge in one jurisdiction makes a demand. For example, let’s suppose that a judge in one jurisdiction demands that the funds be turned over.

If the trust’s location is outside that court’s jurisdiction, it does not have to comply. In other words, it can refuse.

Offshore trust – one major drawback

When beneficiaries repatriate the money, they must pay a higher rate of tax, based on their own income tax position.

In other words, you could end up paying more tax with an offshore trust than an onshore trust. That is if you repatriate the money. ‘To repatriate the money’ means to bring back the money to your country of residence.

What is offshore?

The term ‘offshore,’ in business and finance, means ‘abroad’ or ‘operating overseas.’ However, the terms ‘offshore’ and ‘overseas’ are somewhat misleading. Although they mention ‘sea’ and ‘shore,’ they do not necessarily mean that the other nation is across the sea.

For example, to get from Mexico to the United States, we do not have to cross the sea. However, a US company with a factory in Mexico that makes goods for sale in America participates in offshore production.

An offshore financial center is one that exists in a tax haven. It offers services to companies and individuals from other countries.

If I register a company in, for example, Antigua, but it operates mainly in the UK, it is an offshore company.

A fund that operates in another country is an offshore fund. In many cases, people’s offshore funds are in tax havens.

Offshoring is a general term which refers to the relocation of a business activity abroad.