What is petty cash? Definition and examples

Petty cash is a store of money that is easily accessible, i.e., in the form of cash, that companies and other organizations keep for expenditure on miscellaneous and small items. It is a discretionary cash fund for payments where bank transfers or writing a check (British: cheque) would not be the best or most sensible option.

It is also the general ledger title where accountants or bookkeepers enter the amount of a company’s petty cash.

It is also the general ledger title where accountants or bookkeepers enter the amount of a company’s petty cash.

How much is in the fund varies significantly. Small businesses might have just $50 while larger ones may have up to $500, or even more.

Shopify.com has the following definition of the term:

“Petty cash is a small amount of actual cash that a company has on hand to purchase items that cost so little that cutting a check doesn’t make sense or isn’t realistic.”

“It is often used to reimburse employees for relatively low-cost purchases, such as a birthday cake for an employee or breakfast treats for the morning staff meeting.”

Examples of petty cash payments

A company may use this fund for the following expenses:

- Office supplies.

- Delivery charges.

- Travel expenses.

- Coffee, sugar, milk, biscuits, and other employee snacks.

- Franking, Notary charges, stamps, and small bank charges.

- Gifts for clients or special customers.

- Soap, toilet paper, and cleaning products.

- Van or truck wash.

- Vehicle fuel.

- Casual labor.

- Flowers.

- Cards.

- Miscellaneous expenses.

In accounting, miscellaneous refers to small, infrequent transactions.

Custodian

Upper management or somebody in accounting typically appoints a person to be responsible for the fund. We call that person the petty cash custodian, petty cashier, or simply custodian.

They must make sure that everybody adheres to the fund’s rules and regulations, request top-ups (replenishments), and pay for things (dispense funds).

Do not give all employees access to the fund. If you do, the incidence bad record-keeping or even theft will be significantly greater.

Courses.LumenLearning.com says the following regarding the custodian and the use of vouchers:

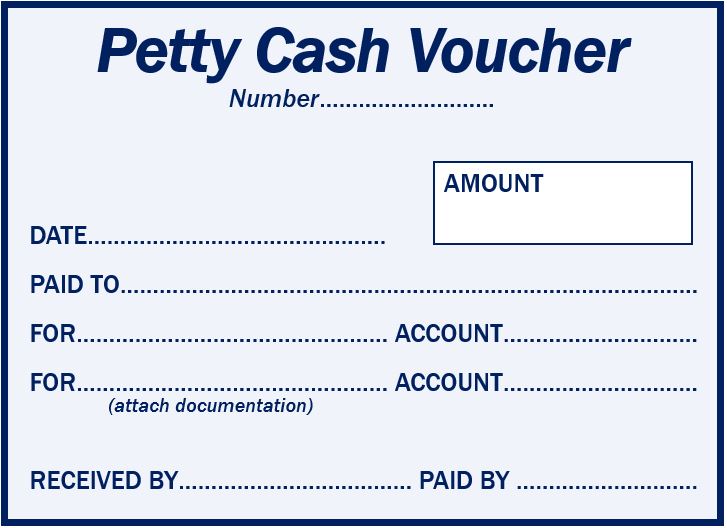

“When disbursing cash from the fund, the petty cash custodian prepares a petty cash voucher, which should be signed by the person receiving the funds.”

“A petty cash voucher is a document or form that shows the amount of and reason for a petty cash disbursement.”

Keeping petty cash transaction records

It is crucial that all payments and top-up monies are recorded. Make sure there is a petty cash slip or voucher for each transaction. When you record a payment, include the date and a description of that expenditure (what you used the money for).

Your records must specify how and why payments were made. It is also crucial that all expenditures are business/work related.

According to Billomat, which created and sells a cloud-based accounting software program:

“The difference with cash payments made by customers should tally with the total petty cash expenses from the drawer.”

“As your office fund drawer gets below the pre-set amount, you need to determine the add to the drawer by having a check to cash in with the words “Petty Cash.'”

Etymology of petty cash

Etymology is the study of the origin of words and how their meanings have evolved over time.

The word ‘Petty’ first appeared in the English language in the late fourteenth century. At that time, it meant ‘Small.’ It came from the Old French word ‘Petit,’ which meant ‘Small.’ It wasn’t until about 100 years later that it began to also have a disparaging meaning (as it does today in the phrase “don’t be petty,”).

The first written record of ‘Petty Cash’ with its modern meaning, that we know of, was dated 1834.