In finance, a Portfolio is a spread of investment products held by an individual, hedge fund, corporation, or financial institution.

The value of each asset in a portfolio determines its risk/reward ratio, which we call their asset allocation.

With proper asset allocation, the long-term goal is to maximize expected returns and minimize risk.

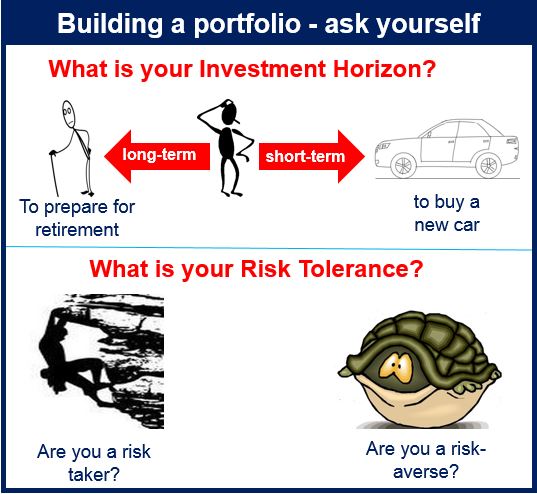

We create our spread of investments according to our levels of risk tolerance. We also take into account our investment objectives and time frames.

People’s portfolios form part of their personal finances.

Managing a portfolio

There are numerous ways of managing investment portfolios. Notable approaches include arbitrage pricing theory, price-weighting, risk parity, and the capital asset pricing model. There’s also the value at risk model, the Jensen Index, equal weighting, and capitalization-weighting.

We calculate returns and performances that portfolios achieve by using quarterly or monthly money-weighted returns.

Another way is by using the true time-weighted method, i.e., it compensates for external flows.

A mix of stock types

All portfolios should have a good spread of investments. When purchasing shares, you should have a mix of defensive stocks and cyclical stocks.

Defensive stocks are those that belong to companies that withstand recessions and economic fluctuations. Utility companies, for example, do well regardless of the economic climate.

In this context, the term ‘economic climate‘ means the same as ‘economic conditions.’

Cyclical shares do well when the economy is booming, but suffer during hard times. Car companies, vacation providers, and producers of luxury goods, for example, issue cyclical shares.

Not all investments spread over a wide area. Mutual funds, for example, have focused funds and diversified funds. Focused funds invest in no more than thirty companies and a maximum of three sectors. They contrast with diversified funds.

Portfolio manager

A person in charge of clients’ portfolios is a portfolio manager. This person works alongside researchers and investment analysts.

To have portfolios with more successful outcomes, individuals may get together and form investment clubs. In these clubs, investors pool their money together before purchasing financial products.