In finance, Quick Ratio measures a company’s ability to use its most liquid assets to clear all current liabilities. The calculation tells us whether a firm might have difficulties in covering its short-term obligations, debts to be cleared within the next 12 months.

Quick assets include current assets that can be cashed out at close to their book values. Companies with a quick ratio of below 1 cannot completely pay back their current liabilities.

It is calculated using the following formula:

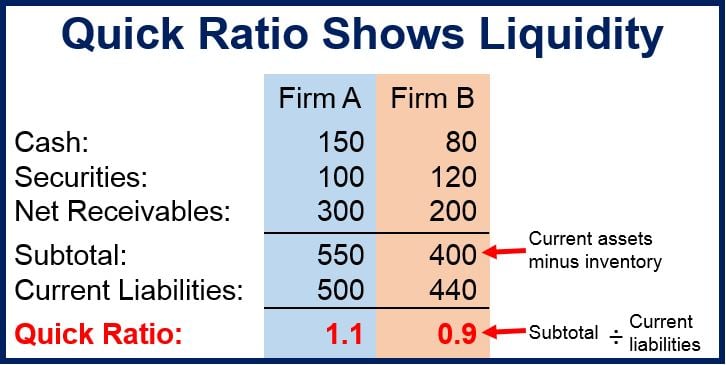

Quick ratio = (current assets – inventories) ÷ current liabilities

It also equals (cash and equivalents + marketable securities + accounts receivable) ÷ current liabilities.

Firm A has a higher quick ratio than Firm B. This implies that Firm A is more liquid.

Firm A has a higher quick ratio than Firm B. This implies that Firm A is more liquid.

A quick ratio of 2.5 means that a company has $4.5 million of liquid assets available to pay off $2 million of current liabilities. It is a key measure of a company’s liquidity position (the ability of a company to meet current obligations using its liquid assets).

This is one of several ratios (financial ratios) that shareholders, managers within a company, creditors and analysts use to compare how well a firm is doing against competitors, the industry average, or its own past figures.

The quick ratio should not be confused with the current ratio, which also includes inventory in the equation.

Quick ratio is not the same as current ratio. The former excludes some current assets from the calculation, such as inventory, because inventory might not turn to cash rapidly. In times of recession, for example, most firms find it much harder to shift their inventory.

However, there is one notable issue with the quick ratio in that it includes accounts receivable as a method of generating cash quickly, which are sometimes slightly below its book value – because of credit losses and discounts.

Quick ratio is also known as the “quick assets ratio” or the “acid-test ratio”.

Cash ratio is a more restrictive way to calculate a company’s ability to pay off its short-term obligations – it only includes cash and cash equivalents in the formula.

Company’s liquidity

In the world of business, understanding a company’s liquidity matters a lot to various stakeholders. The quick ratio provides us with a clearer picture of a business’ short-term financial health.

Current ratio may overstate liquidity by including inventory.

Quick ratio tells us, for example, whether a company can pay its bills without selling its inventory.

Video – What is Quick Ratio