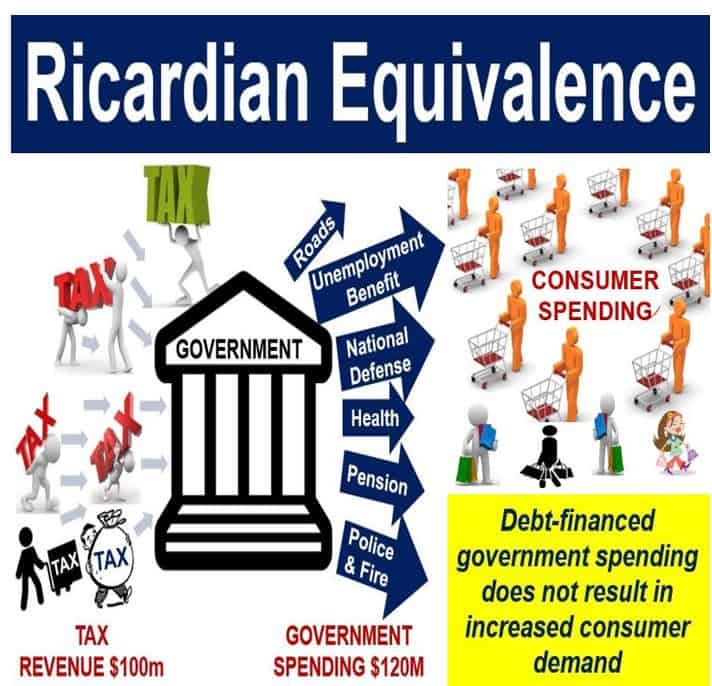

The Ricardian equivalence proposition is an economic theory – developed by British 19th century political economist David Ricardo (1772-1823) – that suggests that when the government attempts to stimulate the economy by raising debt-financed government spending, demand does not increase, but remains the same. Ricardo’s controversial idea suggests that a government deficit has no effect on overall demand within an economy.

Ricardo, one of the most influential of the classical economists, argued that taxpayers know that a government deficit has to be repaid later on, so they boost up their savings in anticipation of heftier tax bills.

In order to increase their current savings, taxpayers reduce their current consumption.

Therefore, any attempts by the government to boost the economy by raising public spending or reducing taxes will not trigger a private-sector reaction, according to the Ricardian equivalence proposition.

The Ricardian equivalence proposition suggests that when the government tries to stimulate GDP growth by increasing borrowing, demand remains unchanged. Consumers know the government is getting into debt, and they increase their savings because they expect taxes will go up in future to repay the debt. If this is the case, fiscal policy is redundant.

The Ricardian equivalence proposition suggests that when the government tries to stimulate GDP growth by increasing borrowing, demand remains unchanged. Consumers know the government is getting into debt, and they increase their savings because they expect taxes will go up in future to repay the debt. If this is the case, fiscal policy is redundant.

Ricardian equivalence and fiscal policy

The Ricardo equivalence proposition has implications for fiscal policy. If the theorem holds true, then fiscal policy is redundant.

In the 1890s, Antonio de Viti de Marco (1858-1943), an Italian economist, elaborated on Ricardian equivalence.

It was further revised by Robert Barro, an American classical macroeconomist and the Paul M. Warburg Professor of Economics at Harvard University. Prof. Barro developed the Ricardian equivalence theory into a significantly more elaborate version of the same concept.

Hence, the Ricardio equivalence proposition is also called the Ricardo–De Viti–Barro equivalence theorem.

According to the Economist’s glossary of terms, the Ricardian equivalence by definition is:

“The controversial idea, suggested by David Ricardo, that government deficits do not affect the overall level of demand in an economy. This is because taxpayers know that any deficit has to be repaid later, and so increase their savings in anticipation of a tax bill.”

David Ricardo, born in London in 1772, contributed significantly to the concepts behind the labor theory of value, comparative advantage, the law of diminishing returns, economic rent, and the Ricardian equivalence theory. (Image: famouseconomists.net)

David Ricardo, born in London in 1772, contributed significantly to the concepts behind the labor theory of value, comparative advantage, the law of diminishing returns, economic rent, and the Ricardian equivalence theory. (Image: famouseconomists.net)

Ricardian equivalence – elaboration by Barro

Prof. Barro provided some theoretical foundation in 1974 to Ricardo’s speculation in an article – ‘Are Government Bonds Net Wealth?’, published in the Journal of Political Economy. Apparently, Prof. Barro was unaware of Ricardo’s earlier notion and De Viti’s elaboration.

Prof. Barro’s model assumed that:

- Families act as infinitely-lived dynasties due to intergenerational altruism.

- All the capital markets are perfect; within them everybody can borrow and lend at a single rate.

- Government expenditures’ path is fixed.

Under these conditions, if bonds are issued by governments to finance deficits, the bequests that families hand down to their offspring will be just big enough to offset the increased taxes that will be required to pay off those bonds.

Barro wrote:

“In the case where the marginal **net-wealth effect of government bonds is close to zero … fiscal effects involving changes in the relative amounts of tax and debt finance for a given amount of public expenditure would have no effect on aggregate demand, interest rates, and capital formation.”

** The wealth effect is an economic theory that when people’s assets – such as stocks, bonds and property – rise in value, their sensation of being richer encourages them to spend more, which boosts GDP growth.

In another article – ‘On the Determination of the Public Debt‘, published in the Journal of Political Economy in 1979, Prof. Barro explained the Ricardian equivalence theorem as follows:

“Shifts between debt and tax finance for a given amount of public expenditure would have no first-order effect on the real interest rate, volume of private investment, etc.”

Prof. Barro pointed out that “the Ricardian equivalence proposition is presented in Ricardo,” even though Ricardo himself was uncertain whether his proposition held true.

Antonio de Viti de Marco was an Italian economist. He was professor of public finance in Rome from 1887 to 1931. In 1931, he refused to take an oath of loyalty to the Fascist regime and resigned. De Marco has long been described as ‘an unyielding defender of liberalism’. He was the first to elaborate on the Ricardian equivalence proposition. (Image: devitidemarco.gov.it)

Antonio de Viti de Marco was an Italian economist. He was professor of public finance in Rome from 1887 to 1931. In 1931, he refused to take an oath of loyalty to the Fascist regime and resigned. De Marco has long been described as ‘an unyielding defender of liberalism’. He was the first to elaborate on the Ricardian equivalence proposition. (Image: devitidemarco.gov.it)

Criticism of the theory of Ricardian equivalence

Some economists criticize the theory, arguing that all consumers are not always rational. A significant proportion of the taxpaying population would not anticipate that tax cuts today would mean higher taxes tomorrow.

The notion that tax cuts are saved is a misleading one. During a recession, people’s average **propensity to consume may fall. However, this is not the same as the marginal **propensity to consume.

** Propensity refers to what proportion of an individual’s income is channeled into consumption or savings.

Robert Joseph Barro, born in New York, was ranked as the fifth most influential economist globally in March 2016 by the Research Papers in Economics. He is considered one of the founders of new classical macroeconomics. He is a Harvard University Professor as well as a Senior Fellow at Stanford University’s Hoover Institution. (Image: scholar.harvard.edu/barro)

Robert Joseph Barro, born in New York, was ranked as the fifth most influential economist globally in March 2016 by the Research Papers in Economics. He is considered one of the founders of new classical macroeconomics. He is a Harvard University Professor as well as a Senior Fellow at Stanford University’s Hoover Institution. (Image: scholar.harvard.edu/barro)

According to evidence, consumers do spend some of the tax cuts, even if the average propensity to save goes up.

Tax cuts may boost GDP (gross domestic product) growth and reduce borrowing requirements. In a recession, lower tax revenues, greater spending on unemployment benefits, and other automatic stabilizers lead to higher government borrowing.

If tax cuts stimulate spending and GDP growth, the increased economic growth will help boost tax revenues and reduce government borrowing. Therefore, a $500 billion stimulus package does not necessarily mean that taxes have to go up by $500 billion.

The government’s fiscal position will improve considerably if the growth rate increases and the economy pulls out of recession.