Risk premium refers to the difference between the expected return on a portfolio or investment and the certain return on a risk-free security or portfolio. It is the additional return that an investor requires to hold a risky asset rather than one that is risk free. Underlying the term risk premium is the idea that there should be a higher expected return – a premium for bearing risk. Many experts claim that there is no reason why some type of premium should be associated with all types of risk.

In other words, a risk premium is the expected excess return on an investment, where the excess return is the difference between the return of a risk-free security and an actual return.

Risk premium may also be a measure of the extra return that an investor demands to bear risk – a market portfolio’s reward-to-risk ratio.

** Total return includes all the dividend or interest payments plus capital gains (the rise in the value of the asset).

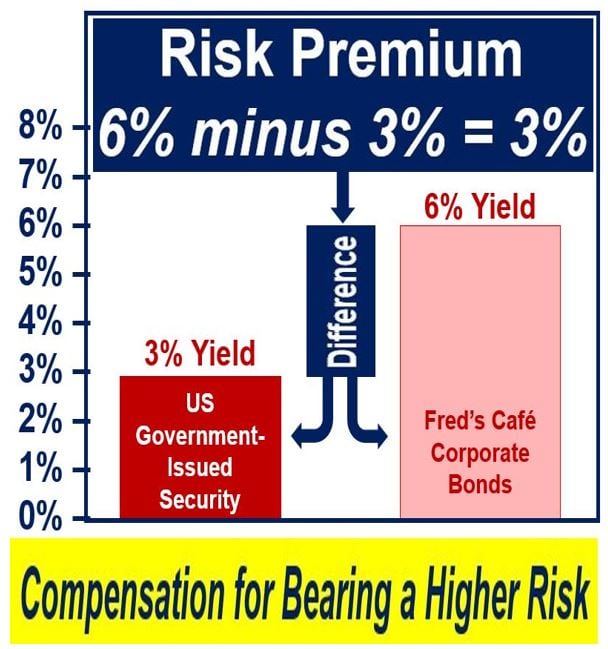

How much more is the yield on the Fred’s Café bonds than the US government-issued security? The answer is 3%. US government-issued securities are considered as ‘risk free’, while the Fred’s Café ones carry a considerably greater risk, that is why their yield is double. The 3% difference between the two is the risk premium.

How much more is the yield on the Fred’s Café bonds than the US government-issued security? The answer is 3%. US government-issued securities are considered as ‘risk free’, while the Fred’s Café ones carry a considerably greater risk, that is why their yield is double. The 3% difference between the two is the risk premium.

Risk premium – form of compensation

Investors see risk premium as a type of compensation for bearing the additional risk, compared to that of an asset with virtually no risk, in a given investment.

High-quality corporate bonds, for example, those that are issued by established blue-chip companies earning large profits, have the smallest risk of default in the private sector. Such bonds, therefore, pay a lower rate of interest (yield) compared to bonds that less-established commercial enterprises issue; companies with uncertain profitability or a relatively higher risk of default.

If a U.S. government-issued security – which is classed as the most risk-free investment available – pays 3% per year, and that of the less-established firm pays 6%, the risk premium is 6 minus 3, which equals 3%.

Companies that issue bonds, for example, with higher yields, are giving a form of hazard pay to the investors who are willing to bear the greater risk – they get compensation for the risk they undertake.

An investment that is not ‘risk-free’ must have something appealing to attract investors, such as a higher potential rate of return. How much that rate of return is, compared to the much safer bets, is the risk premium.

In a game show, to get a decent number of people to choose Option A – open the door to see what is hidden behind it – rather than take the cash, you need a good risk premium; otherwise most of us would opt for taking the cash. We have a tendency to be risk averse.

In a game show, to get a decent number of people to choose Option A – open the door to see what is hidden behind it – rather than take the cash, you need a good risk premium; otherwise most of us would opt for taking the cash. We have a tendency to be risk averse.

Risk premium in a game show

Imagine a game show offers a participant to choose one of two doors: if she opens one door she wins $1,000, but will get $0 if she opens the other.

The contestant is also given the choice of taking no risk and walking away with $500 cash. The two options – choosing between one of the doors or taking $500 – have an identical ** expected value of $500, therefore no risk premium has been offered for choosing the doors instead of taking the guaranteed $500.

** The ‘expected value’ is the sum of what is behind the doors divided by the number of doors. In this case, the expected value is $1000 plus $0 divided by 2, which equals $500.

A risk neutral contestant – one who is insensitive to risk – will be indifferent between the two choices. A risk averse contestant – one who prefers certainties to taking risks – will choose the guaranteed $500. A risk seeking contestant – one who thrives on uncertainty – will choose the two-doors option.

Given that most of us are somewhat risk averse, in order to get more people to choose the two-doors option, the game show organizers will have to offer a greater potential prize behind one of the doors.

If the prize is increased to $1,600, thus raising the expected value of choosing between the two doors to $800, the risk premium becomes: $800 (the expected value) minus $500 (guaranteed), which equals $300.

Participants who require a minimum risk premium smaller than $300 will be more likely to choose the two-doors option rather than the guaranteed $500 if one of the doors has $1,600.

Video – Definition of Risk Premium

This UT McCombs School of Business video explains what risk premium is using simple language, clear examples and easy-to-understand concepts.