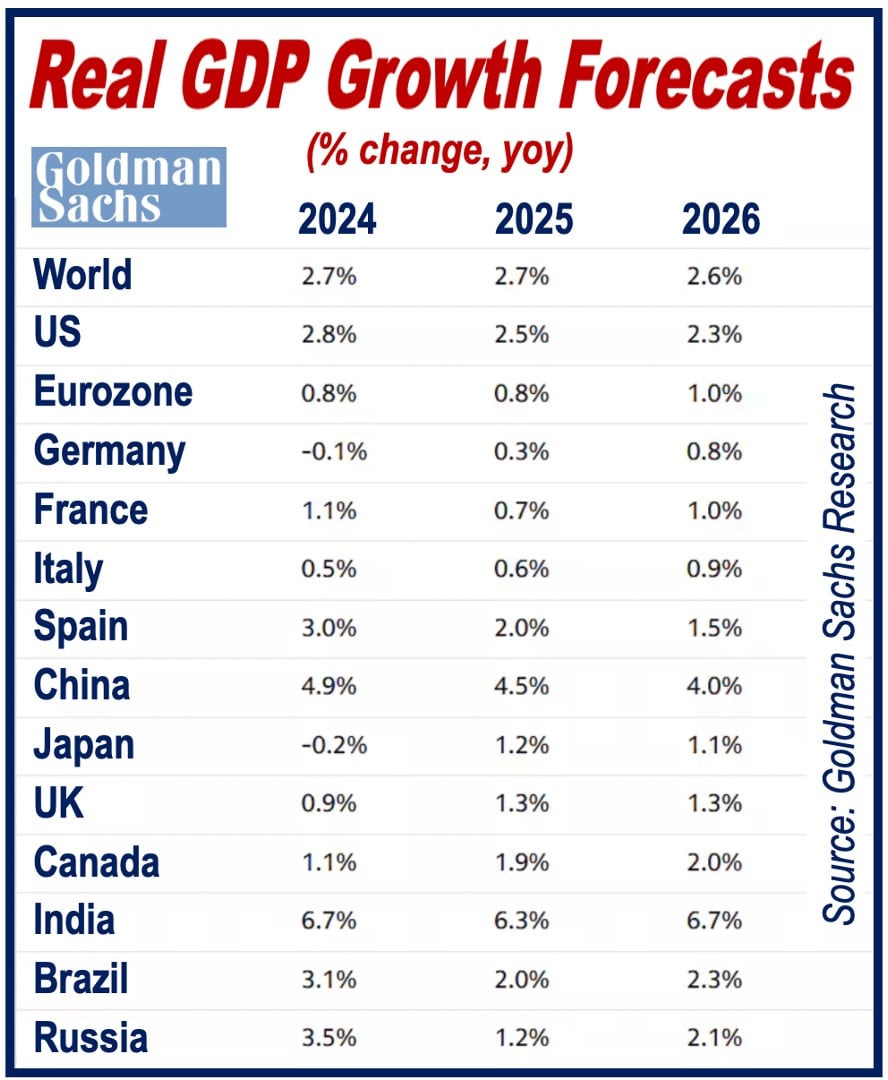

After strong global GDP growth in 2024 of 2.7%, Goldman Sachs Research forecasts that the world economy will expand by 2.7% in 2025 and 2.6% in 2026.

Goldman Sachs economists believe that the US will exceed expectations in 2024, 2025, and 2026, with GDP growth rates of 2.8%, 2.5%, and 2.3%, respectively.

The Eurozone, on the other hand, is projected to lag behind with growth rates of 0.8% in 2024, 0.8% in 2025, and 1.0% in 2026.

Goldman Sachs Research Chief Economist Jan Hatzius and team laid out their projections in a report titled “Macro Outlook 2025: Tailwinds (Probably) Trump Tariffs.”

Hatzius explained,

“Inflation has continued to trend down and is now within striking distance of central bank targets. And most central banks are well into the process of cutting interest rates back to more normal levels.”

For the third consecutive year, the US economy is expected to grow faster than its major competitors—other advanced economies.

Danger of Across-the-Board Tariffs

Donald Trump’s re-election will most probably lead to greater *tariffs on Chinese goods and imported cars, regulatory easing, some new tax cuts, and lower immigration.

* “Tariffs” are taxes on imported products.

Hatzius warned, “The biggest risk is a large across-the-board tariff, which would likely hit growth hard.”

Will trade changes drive up US inflation?

By late 2025, US *core PCE inflation is expected to slow to 2.4%, which is more than the Goldman Sachs economists’ previous forecast of 2.0%, but still a manageable level.

* “Core PCE (Personal Consumption Expenditures) Inflation” measures the change in prices for goods and services but excludes volatile food and energy prices.

If the Trump administration imposes a 10% tariff on all imports—an across-the-board tariff of 10%—US core PCE inflation would rise to approximately 3%.

The economists predict that core inflation in the Eurozone will slow to 2% by the end of 2025. In Japan, there is now a much lower risk of ultra-low inflation.

Hatzius wrote,

“A key reason for optimism on global growth is the dramatic inflation decline over the past two years. This directly supports real income because price inflation has fallen far more quickly than wage inflation.”

“Just as importantly, the inflation decline also indirectly supports demand by allowing central banks to normalize monetary policy and thereby ease financial conditions.”

Interest Rates

Goldman Sachs economists expect the US Federal Reserve System (Fed) to reduce its *policy rate from the current 4.5%-4.75% to 3.25%-3.5%, with more cuts through the first quarter and then a slowdown.

* The “Fed’s Policy Rate” is the interest rate it sets to influence borrowing and spending in the economy, which affects overall economic activity and inflation.

They predict that the European Central Bank will reduce its policy rate to a terminal rate of 1.75%.

Goldman Sachs Research added,

“Our economists find that there’s also significant room for policy easing in emerging markets. By contrast, the Bank of Japan is projected to lift its policy rate to 0.75% by the end of 2025.”

Impact of Trump’s Trade Policy on US Economy

Goldman Sachs researchers believe that the United States’ trade policies will have only a small impact on the country’s economy, with much of the effect likely offset by other factors.

Tariffs would lead to higher prices for consumers and businesses, slightly reducing disposable personal income.

The uncertainty over whether trade tensions might escalate further could also weigh on business investment.

Hatzius wrote:

“Assuming that the trade war does not escalate further, we expect the positive impulses from tax cuts, a friendlier regulatory environment, and improved ‘animal spirits’ among businesses to dominate in 2026.”

The economists believe that trade policies may cut US GDP growth by 0.2 percentage points in 2025. They added, “If larger than anticipated across-the-board tariffs are implemented, that could cause a net drag averaging 1 percentage point in 2026 (though it could be lower if tariff revenue is fully recycled into tax cuts).”

The US economy has expanded faster than other advanced economies and will probably continue doing so.

US labor productivity has increased by 1.7% annually since the end of 2019, a noticeable increase from the pre-pandemic trend of 1.3%.

In contrast, labor productivity in the Eurozone has grown at an annualized rate of just 0.2% over the same period, a significant slowdown from its pre-pandemic rate of 0.7%.

Hatzius wrote,

“We expect US productivity growth to remain significantly stronger than elsewhere, and this is a key reason why we expect US GDP growth to continue to outperform.”

Effect of US trade policies on other nations

US trade policy is likely to hurt other economies more than the US.

-

Eurozone

In the Eurozone, an increase in trade policy uncertainty to the peak levels seen during the 2018-19 trade conflict would reduce GDP by 0.3% in the US but by up to 0.9% in the Eurozone.

Goldman Sachs wrote,

“Our economists reduced their growth forecast for the euro area in 2025 following the US election results by 0.5 percentage points (fourth quarter over fourth quarter) and would likely cut it further if the US imposes an across-the-board tariff.”

-

China

According to Goldman Sachs economists, US trade policy’s impact on China will be even more direct. Trump threatened to impose tariff increases on Chinese goods by up to 60 percentage points. If he makes good on that threat, it would reduce China’s GDP growth for 2025 by 0.7 percentage points, the economists forecast.

Goldman Sachs wrote,

“Our economists reduced their 2025 growth forecast modestly, by 0.2 percentage points on net to 4.5%, assuming Chinese policymakers provide stimulus and some of the growth hit is offset by depreciation in the renminbi (yuan).”

Hatzius added, “However, we would likely make larger downgrades if the trade war were to escalate further.”

Conclusion

Goldman Sachs Research expects global GDP to grow solidly despite Trump’s promised tariffs. Changes to US trade policy should cut global GDP growth by 0.4 percentage points, while additional policy support should help soften the impact.

Without knowing the extent of any new trade restrictions, making precise forecasts is impossible. If the new US administration imposes a 10% across-the-board tariff, the impact could be two to three times greater.

Hatzius wrote,

“Barring a broader trade war, policy changes in the second Trump administration are unlikely to change the broad contours of our global economic views.”