Will the latest (fourth) AbbVie Shire takeover bid worth $51.3 billion (£30.1 billion) do the trick? AbbVie’s share plus cash offer comes to £51.15 per share, comprising £22.44 in cash and 0.8568 AbbVie shares per Shire share, and beats June’s proposal by 11%.

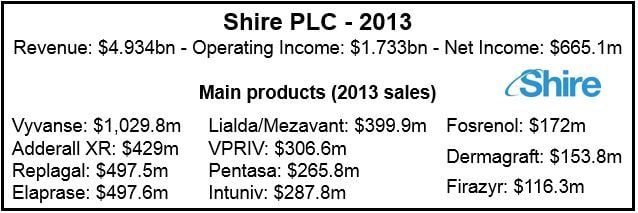

In June, Shire had turned down AbbVie’s offer, saying it undervalued the company’s true worth. Dublin-based Shire PLC, which specializes in making medications for rare diseases, had argued that it had a better future on its own. After doubling its revenue during the last five years, Shire believes it can do it again and reach $10 billion by the end of the decade.

Richard Gonzalez, AbbVie’s CEO, described the increased bid as “a compelling offer (that) creates immediate and long-term value to shareholders of both companies. We think its shareholders should strongly encourage the Shire board to engage in constructive dialogue with AbbVie.”

In a statement, Irish drugmaker pointed out that AbbVie chose to make its new proposal public before communicating with Shire beforehand.

Shire stated today:

“The Board of Shire will meet to consider the proposal and a further announcement will be made in due course. Shareholders are strongly advised to take no action in relation to the AbbVie proposal. There can be no certainty that any firm offer will be made nor as to the terms on which any firm offer might be made.”

“This statement is being made by Shire without the prior agreement or approval of AbbVie.”

AbbVie lists the benefits of the new offer

AbbVie, based in Chicago, Illinois, said it had spoken to stockholders who own a majority of Shire’s outstanding shares before making the latest improved offer.

AbbVie says its fourth proposal represents:

- an 11% increase and a c. £3 billion to the indicative offer value of £46.26 per share,

- a c. 10% increase in cash per Shire share,

- a 75% premium to Shire’s closing share price on April 17th, 2014, of £29.25, and c. £13 billion of incremental aggregate value for Shire’s shareholders,

- a 48% premium of Shire’s closing share price on May 2nd, 2014, of £34.67 (the last practicable date before AbbVie’s original proposal), and c. £10 billion of incremental aggregate value for Shire’s shareholders, and

- an implied Enterprise Value / Last 12 Months’ EBITDA (as reported by Shire) multiple of about 25x.

“This transaction is a combination of two leading companies with leadership positions in

specialty pharmaceuticals that would create a global market leader with unique characteristics

and a compelling investment thesis.”

“AbbVie will bring greater financial strength and R&D experience to this combination that will enable both companies to reach their full potential for their shareholders and patients in need across the globe.”

AbbVie wants to pay less tax

Shire has repeatedly warned its shareholders against a takeover based entirely on Ireland’s lower corporate tax rate. Corporate tax in the US, at 38%, is the highest among the advanced economies.

Several US-based companies have been trying to buy UK, Swiss or Irish businesses so that they can then move their headquarters either to the United Kingdom with a 21% tax rate, Ireland where corporate tax is 12.5%, or Switzerland.

Acquiring Shire and moving to Ireland would mean a massive cut in AbbVie’s tax bill.

US-based Pfizer, the world’s largest drug company, recently tried unsuccessfully to buy Britain’s second biggest pharmaceutical company AstraZeneca. Some of Pfizer’s executives openly admitted that the UK’s more business-friendly corporate tax rate was an important reason for Pfizer to pursue a bid for AstraZeneca.

Yesterday, Illinois-based Archer Daniels Midland Company (ADM) announced an agreed takeover deal worth $3.13 billion with Swiss-based Wild Flavors. Although ADM made no mention of Switzerland’s favorable 17.92% corporate tax rate, many analysts in Wall Street believe the US agribusiness multinational has a tax-inversion plan.

The US tax system needs an overhaul, several US economists and lawmakers say. The Council on Foreign Relations stated in May that the “US Corporate tax system keeps money abroad.”

Shire has several promising experimental drugs

AbbVie is desperately trying to find a way of diversifying its drug portfolio. Nearly 60% of is current revenue comes from Humira (adalimumab), used for treating patients with rheumatoid arthritis. In 2016, Humira will lose its patent protection and thus most of its income when cheaper generic alternatives come flooding in.

Shire’s future looks much more rosy. It has a promising pipeline of experimental medications which are expected to become good earners one day. Buy acquiring Shire, not only would AbbVie be paying much less corporate tax, it would also have access to products which could replace Humira’s declining income when its patent expires.

Not only does Shire currently have products that sell well, but also a promising portfolio of drugs in the pipeline.

Video – What is takeover?

This video explains what takeovers and acquisitions are. Mergers, on the other hand, are quite different.