Morgan Stanley Q2 earnings surged, driven mainly by a strong performance in the company’s wealth management operations. The American multinational financial services corporation has been struggling with erratic results ever since the financial crisis. It is still not happy with broker compensation costs.

The owner of the world’s largest brokerage, which once depended on its powerful trading businesses, has been looking into other areas with more reliable and stable sources of revenue. The strategy appears to finally be paying off; wealth management provides a more regular flow of income.

Morgan Stanley’s strong second quarter was also helped by good performances in its stock trading and investment banking segments.

During an uninspiring bond trading period, Morgan Stanley’s strategy has helped it remain better insulated than most of its rivals. The bank has also benefited from a period of strong bond sales, healthy equity markets and its best quarterly M&A activity in seven years.

Both profits and revenue gained

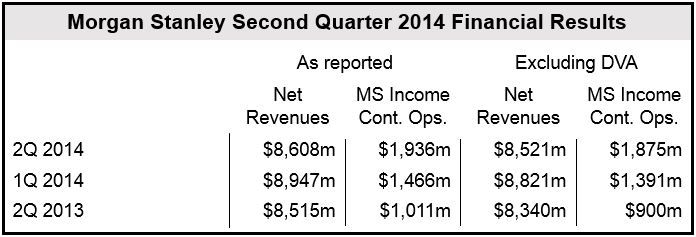

The company posted a $1.3 billion profit in Q2 2014, or 60 cents a share, excluding a large tax benefit and certain charges related to its debt. Revenues increased by 46% (compared to Q2 2013) to $8.5 billion.

The company’s wealth management unit’s pretax income increased to $767 million in Q2 2014, compared to $655 in Q2 2013, a pretax profit margin of 21%. Wealth management represented 36.8% of the company’s total profit.

James P. Gorman, Chairman and CEO of Morgan Stanley, made the following comment about the second quarter results:

“Our quarterly results demonstrated solid performance, despite a muted operating environment. We are seeing momentum across our businesses, with particular strength in Investment Banking, Equity Sales & Trading and Wealth Management – where profit margins hit 21% for the first time since the founding of the JV, and assets entrusted to us by clients reached $2 trillion.”

“We also continued to be disciplined on expenses, while focusing on delivering higher returns.”

Costly recruiting wars among banks

Mr. Gorman says he disagrees with the costly recruiting wars that Morgan Stanley and its rivals are waging to attract or allegedly keep top brokers.

Reuters quotes Mr. Gorman, who said regarding rivals UBS Wealth Management Americas, Wells Fargo Advisors, and Merril Lynch Wealth Management, “Long term, strategically, in an oligopoly you’d expect less movement of financial advisers between firms. That doesn’t translate yet, but we think it will.”

Earlier this year he said compensation costs at Morgan Stanley Wealth should be 55%, rather than the current 60%. His comment sparked speculation that he might place a ceiling on broker’s pay.

The most effective way of slowing down or even reducing pay growth in relation to revenue growth is for brokers to sell more loans and mortgages, said Chief Financial Officer Ruth Porat.

(Data source: Morgan Stanley)

Return on equity (ROE)

The company has a plan to drive ROE to 10% or higher in 2015, Mr. Gorman said at an investor conference in June. Excluding adjustments for a one-off tax benefit and its own debt, the company’s ROE in Q2 2014 stood at 7.3%, which was much better than last year’s 4.4%.

Part of his plan involves raising dividends and share buybacks. In the next few years, he aims to return as much as 100% of earnings to stockholders.

Morgan Stanley announced a $1 billion share buyback plan for the 12 months ending in March and increased its dividend by 100% to 10 cents a share.

The company says that in Q2 2014 it bought back $284 million.

Q2 results from other banks

- Bank of America’s Q2 2014 net income dropped 43% to $2.3 billion from $3.4 billion in Q2 2013. The bank is also facing a giant settlement with the US Department of Justice to prevent a new lawsuit.

- JPMorgan’s second quarter earnings fell by 8% as it struggles with weak mortgage lending and falling incomes from trading. It posted profits of $6 billion and revenues of $25.3 billion.

- Citigroup’s second quarter income fell to $181 million compared to $4.2 billion in the same quarter last year. Its revenues also fell, to $19.3 billion versus $20.5 billion in Q2 2013. The bank reached an agreement with US authorities to pay $7 billion to resolve an investigation into the sale and issuance of residential mortgage-backed securities in the years leading up to the financial crisis.

- Wells Fargo’s net income increased by 4% to $5.7 billion in the second quarter. Its net income also rose over the six-month period ending on June 30th. Revenue declined by 1%.