What is a Mortgage Rate? Definition and Examples

In the term Mortgage Rate, the word ‘rate’ means ‘interest’. A mortgage rate is the interest that we pay on a home loan. A mortgage is a home loan, i.e., a loan to purchase a property.

The size of the monthly installments on a home loan depends on how much is borrowed as well as the mortgage rate. In this context, the word ‘installment’ means monthly repayments.

The higher the mortgage rate is, the greater the monthly installment will be.

Mortgage Rates: Short- & Long-Term Loans

Shorter-term loans typically have lower mortgage rates compared to 30-year loans. However, shorter-term loans, i.e., 15-year mortgages, have greater monthly payments.

In the world of mortgages, short-term refers to a 15-year loan, while with a long-term loan, the borrower pays over 30 years.

First Foundation has the following definition of the term:

“Mortgage rate is the interest that a mortgage borrower will pay for money borrowed against a mortgage.”

“When a buyer borrows from a mortgage lender, the borrower will pay interest on the amount borrowed, as a fee for the use of the borrowed money.”

Fixed-Rate & Adjustable-Rate Mortgages

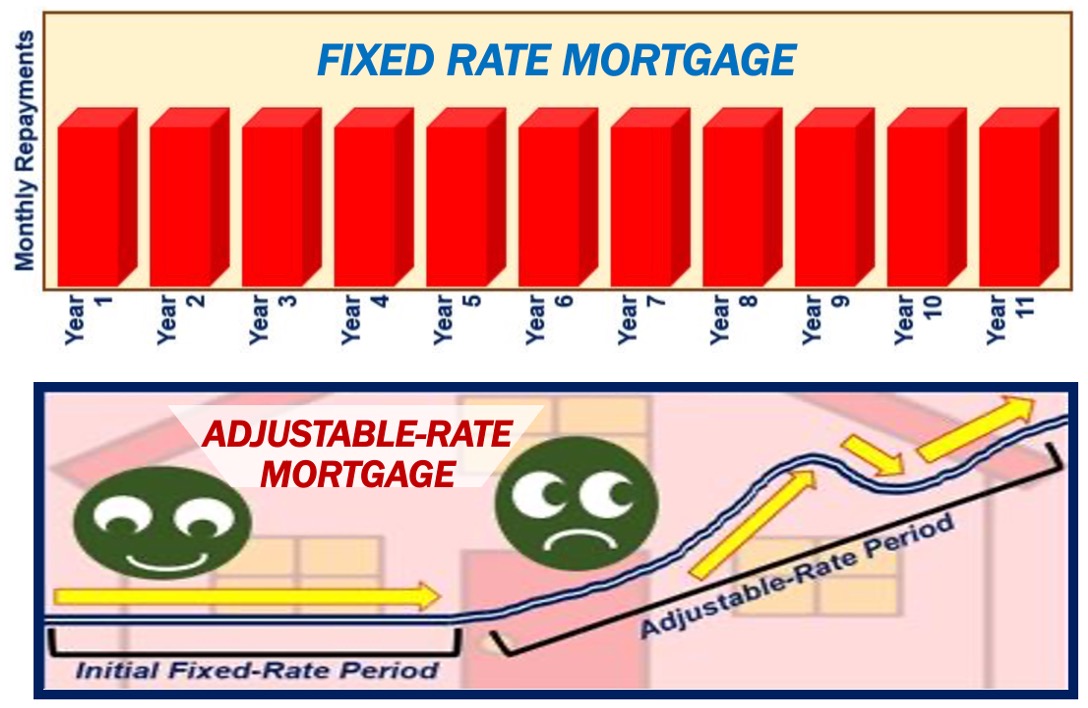

With a fixed-rate mortgage, the mortgage rate remains unchanged throughout the life of the loan. Some people prefer this because of its predictability, which allows them to plan ahead.

With an adjustable-rate mortgage, on the other hand, the interest rate is only fixed for the first few years, after which it might go up or down.

Factors Influencing Mortgage Rates

Your mortgage rate depends on two things, the state of the national economy and your credit score.

-

Benchmark Interest Rates

Your country’s central bank sets its benchmark interest rates, which affect the interest rates on all types of loans, including mortgages.

-

Credit Score

Your credit score is also a factor. People with low credit scores typically have higher mortgage rates than their counterparts with high scores.

The impact of mortgage rate fluctuations

-

Disposable income

Mortgage rate fluctuations can have a major impact on people’s lives. When rates go up, mortgagees face higher monthly payments, which effectively reduce their take-home pay or disposable income.

-

Home sales and prices

Mortgage rate fluctuations can also affect the housing market. When rates go up, home sales fall and so do house prices. Conversely, when rates fall, the opposite happens – home sales and prices rise.

Down Payment – Deposit

If you want to lower the mortgage rate on your loan, ask your bank whether paying a larger down payment on the house you plan to buy might help.

Some lenders see mortgages with large down payments as lower risk loans and may offer a reduced rate.

Americans tend to use the term ‘down payment’ while Britons say ‘deposit’ for the upfront money one places when purchasing a home.

Video- What is a Mortgage Rate?

This video, from our sister channel on YouTube – Marketing Business Network, explains what a ‘Mortgage Rate’ is using simple and easy-to-understand language and examples.