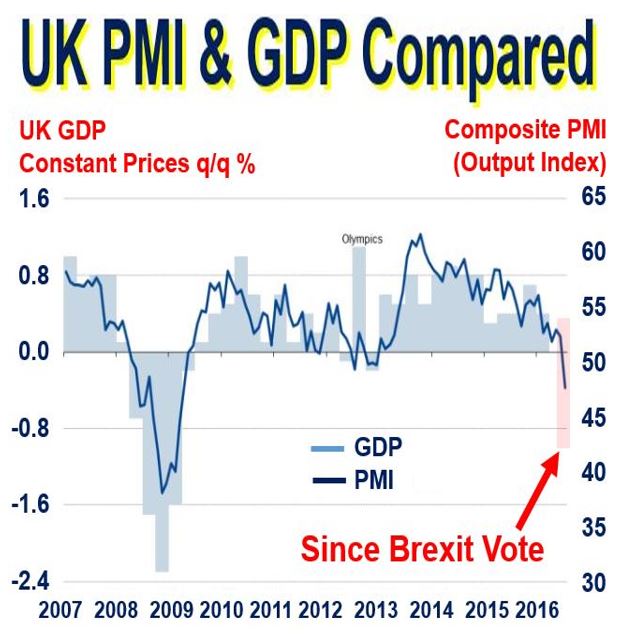

Economic activity in the UK has deteriorated considerably since Britons voted for Brexit – Britain Exiting the EU. Former Prime Minister David Cameron, Bank of England Governor Mark Carney, and hundreds of economists across the world warned that Brexit would cause a serious slowdown in the British economy. It appears that their predictions were right. The Markit PMI (Purchasing Manager’s Index) fell to 47.7 in July, its lowest level since April 2009.

The PMI is an indicator of the economic health of a country’s manufacturing sector. It is based on five key indicators: production, inventory levels, new orders, supplier deliveries and the employment environment.

The PMI provides information about a country’s current business conditions to analysts, purchasing managers and companies’ decision makers.

Since Britons voted on 23rd June to leave the European Union, uncertainty has increased and economic activity is slowing down alarmingly. (Source: ONS, Markit, CIPS)

Since Britons voted on 23rd June to leave the European Union, uncertainty has increased and economic activity is slowing down alarmingly. (Source: ONS, Markit, CIPS)

Slump in orders and output

Any reading below 50 indicates contraction. In July’s PMI figures, both service and manufacturing sectors saw a decline in orders and output.

However, the pound, which declined more than 13% since June’s referendum, has helped boost exports.

The PMI report surveyed over 650 services companies, from a wide range of sectors, including restaurants, computing, business services and transport.

They were asked: “Is the level of business activity at your company higher, the same or lower than one month ago?”

Manufacturers were asked whether production had increased or declined.

July’s PMI is the first major set of data measuring business reaction to the referendum’s Brexit result.

Both the service sector and manufacturing output have posted steep declines over the past month. (Source: ONS, Markit, CIPS)

Both the service sector and manufacturing output have posted steep declines over the past month. (Source: ONS, Markit, CIPS)

Optimism slumped considerably

According to IHS Markit, which published July’s PMI figures, output and new orders both declined for the first time since 2012, while service providers’ optimism about the next 12 months nosedived to a 7.5-year low.

The UK economy’s weaker July figures were especially striking when looking at the month-on-month movements in the index levels.

The Composite New Orders and Composite Output fell by 6.8 and 4.7 points respectively since June; the sharpest declines registered in the series’ histories. The decline in the Services Business Expectations – of 10.4 points – was also the largest ever.

After the Brexit vote the pound declined, which resulted in higher manufacturing output prices. (Source: ONS, Markit, CIPS)

After the Brexit vote the pound declined, which resulted in higher manufacturing output prices. (Source: ONS, Markit, CIPS)

Chris Williamson, Chief Economist at Markit, said:

“July saw a dramatic deterioration in the economy, with business activity slumping at the fastest rate since the height of the global financial crisis in early-2009. The downturn, whether manifesting itself in order book cancellations, a lack of new orders or the postponement or halting of projects, was most commonly attributed in one way or another to ‘Brexit’.”

“The one ray of light was an improvement in manufacturing export growth to the best for two years as the weak pound helped drive overseas sales, though producers also suffered the flip-side of a weak currency as import prices spiked higher.”

“At this level, the survey is signalling a 0.4% contraction of the economy in the third quarter, though much of course depends on whether we see a further deterioration in August or if July represents a shock-induced nadir. Given the record slump in service sector business expectations, the suggestion is that there is further pain to come in the short-term at least.”

“With policymakers waiting to see hard data on the state of the economy before considering more stimulus, the slump in the PMI will provide a powerful argument for swift action.”

Post-Brexit uncertainty taking hold

David Noble, Group Chief Executive Officer at the Chartered Institute of Procurement & Supply, said that as uncertainty following the Brexit vote takes hold, the UK economy has started to suffer sharp falls in new orders and output.

A weaker pound has pushed up input prices for manufacturers. However, Mr. Noble added that one glimmer of hope within all this gloom are exports – which have posted a welcome rise. As the global economy is currently subdued, economists wonder whether our export surge will be long-lasting.

Mr. Noble said:

“Supply chain managers must use this uncertainty to demonstrate what they do best – being agile, adaptive, sourcing the best goods and prices to steer their organisations successfully in the months and years ahead.”

“The true extent of the impact of this uncertainty still remains to be seen next month. But with optimism in the UK’s service sector at a seven-and-a-half year low, policymakers must take swift action to stop further decline amid political upheaval.”

News about the economic slow down confirmed analysts’ expectations that the Bank of England will reduce interest rates next month, which in turn gave London’s stock market a good day.

Video – Brexit causes massive slump in UK economy

One of the key arguments of the Remain campaign – that Brexit would cause an economic slowdown – is becoming reality.