Market Value or Market Price refers to the price that purchasers and sellers both accept. In other words, the price at which they agree to trade a security in an open market. What investors believe a company is worth we refer to as market capitalization. We calculate market capitalization by multiplying the current market price of the entity’s shares by the number of shares outstanding.

The term is similar to, but not the same as intrinsic value.

In an inefficient market, the term refers to the price both buyers and sellers would accept if they had equal access to data. Also, it is the price they would accept if they were free to trade without constraints.

On a commodity or securities exchange, the term refers to the price of the latest trade.

Put simply; market value is how much an asset would fetch in the marketplace. It includes not only how much people would buy it for, but also the right price for the seller.

Market value serves as a critical indicator for mergers and acquisitions, where it can significantly influence the premiums paid during such transactions.

People value companies for many reasons, such as raising additional capital, mergers and acquisition transactions, or to motivate management. We also value a company before listing it on the stock exchange, a divestiture, or taxation purposes.

The market value of a company can have a substantial impact on its ability to secure loans and investments, as it reflects the perceived stability and profitability to lenders and investors.

Determining an asset’s market value

Determining the market value of exchange-traded instruments such as futures and stocks is easy. It is easy because their prices are easily available.

It is more difficult, however, to accurately establish market values of OTC instruments such as fixed income securities. OTC stands for Over the Counter.

Illiquid assets such as businesses and real estate have market values that are particularly challenging to determine. Investors usually have to consult real estate appraisers and business valuation experts.

In accounting, the term refers to the replacement cost of an item after deducting estimated carrying, delivery and selling costs from its estimated selling price. There is a difference between replacement cost and market price.

Nasdaq.com has the following definition of the term:

“(1)The price at which a security is trading and could presumably be purchased or sold. (2) What investors believe a firm is worth; calculated by multiplying the number of shares outstanding by the current market price of a firm’s shares.”

Other terms with the same meaning

We often use the term interchangeably with fair value, fair market value, and open market value. However, in some circumstances, their meaning may vary.

The International Valuation Standards Council says that market value is the estimated amount for which a liability or asset should exchange on the valuation date between a willing seller and a willing buyer in an *arm’s length transaction, after proper marketing and where both the buyer and seller acted knowledgeably, prudently and without compulsion.

*An arm’s length transaction makes sure that the parties in a deal are acting in their own self interest. It ensures that they are not subject to any pressure or duress from the other party.

Dividends and market value

A good way to enhance the market value of a company and its shares is by issuing dividends to stockholders. General Electric, for example, has been doing this for decades, i.e., it regularly issues dividends to shareholders.

People know that General Electric’s pattern of giving dividends is unlikely to change. Therefore, demand for its shares is high. High demand usually means high prices.

Tech companies, on the other hand, hardly ever issue dividends. This is because they are so popular that extra incentives are not necessary.

Fannie Mae definition of market value

Fannie Mae (Federal National Mortgage Association), a US government-sponsored enterprise, explains that market value is the most likely price that a property should bring in an open and competitive market, under all conditions required for a fair sale, with the buyer and seller each acting prudently, knowledgeably, and assuming the price is not affected by undue stimulus.

The following conditions and circumstances are necessary for a proper market value to exist:

- Both the buyer and the seller are keen.

- Both parties have received comprehensive information and advice. Also, they are acting in their own interests.

- Exposure of the property has been allowed in the open market for a reasonable amount of time.

- The buyer is paying with cash in local currency. Alternatively, the terms of the financial arrangements are comparable to cash.

- “The price represents the normal consideration for the property sold unaffected by special or creative financing or sales concessions granted by anyone associated with the sale.”

Market vs. book value

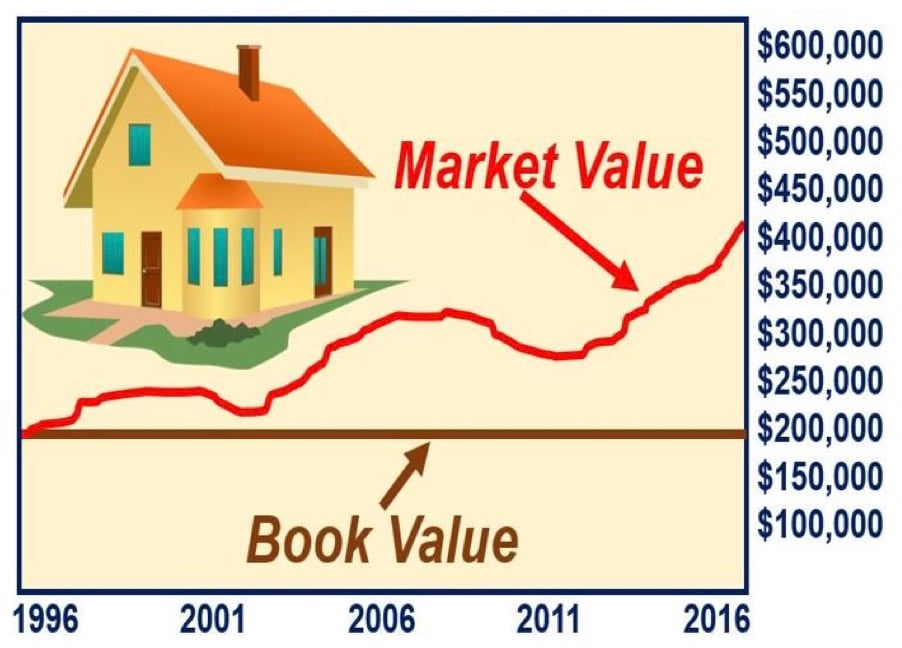

If you bought a house twenty years ago for $200,000, its book value on day one was $200,000. It is still that amount today.

Market value, however, changes during that twenty-year period. It refers to how much you would get if you sold the house at any given moment.

Imagine that prices doubled ten years after you had bought the house. Its market value would subsequently have been $400,000, i.e., double what you paid for it.

Let’s suppose that property prices have increased threefold over the past two decades. Your house’s current market value would be $600,000 (200,000 times 3).

The book value of an asset is important, especially for the tax office. It helps track profit and losses. The difference between an asset’s book and market values tells us what profit or loss the owner has made.

Market value vs. volume

Market value may also refer to the monetary value of a whole market. Market volume, on the other hand, looks at the total amount of transactions.

For example, if 935 customers bought a company’s MRI scanner last year, the market volume was 935. If each scanner sold for $1 million, the market value was $935 million.

Terms related to “market value”

In business/economics/finance English, there are many compound nouns containing the words “market value.” Compound nouns are terms that contain two or more words. Let’s take a look at seven such compound nouns, their meanings, and how we can use them in a sentence:

-

Market Value Assessment

An evaluation to estimate the market value of a property, often for tax purposes.

Example: “The tax authorities conducted a market value assessment to determine the property tax dues.”

-

Market Value Ratio

A financial ratio that compares the market value of a company to some element of its financial statement, like book value or sales.

Example: “Analysts looked at the market value ratio to evaluate the company’s current share price against its book value.”

-

Market Value Adjustment

A change in the book value of assets or liabilities to reflect the market value.

Example: “The market value adjustment was made on the investment portfolio to reflect current stock prices.”

-

Market Value Analysis

The process of examining various market factors to determine the market value of an asset.

Example: “Before making an offer, the investor did a thorough market value analysis of the commercial real estate.”

-

Market Value Increase

An upward movement in the market value of an asset over a period of time.

Example: “The market value increase of her art collection over the past decade was impressive.”

-

Market Value Policy

An insurance policy that compensates for the loss based on the market value of the insured item.

Example: “After the fire, the market value policy provided coverage based on the current market price of the damaged goods.”

-

Market Value Pricing

Setting the price of a good or service based on its perceived market value rather than cost-plus pricing.

Example: “They used market value pricing to set competitive rates for the luxury apartments.”

Two Educational Videos

These two educational videos featured on our partner YouTube channel, Marketing Business Network, explain the meanings of ‘Market Value’ and ‘Economic Value,’ utilizing easy-to-understand language and examples.

-

What is Market Value?

-

What is Economic Value?