Has a BNP Paribas settlement been agreed? According to US and European media on Sunday, BNP has agreed to pay $8.9 billion and will plead guilty to criminal charges that it violated US sanction rules (the International Emergency Economic Powers Act) by doing business with rogue nations such as Cuba, Sudan and Iran between 2002 and 2009.

Apparently, BNP concealed transactions with rogue nations totaling approximately $30 billion.

According to Bloomberg, BNP has been negotiating with federal and state authorities regarding the penalty, which would be very close to a record $9 billion for such a violation.

The financial penalty will be split between:

- The Office of Foreign Assets Control,

- Manhattan’s district attorney, and

- New York state’s Department of Financial Services.

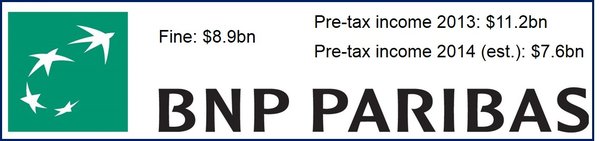

France’s largest bank will see most of its 2013’s $11.2 billion pre-tax income wiped out by the reported fine. It plans to pay it by issuing bonds and slashing its dividends, the Wall Street Journal informed.

BNP Paribas has paid out a dividend every year for the last 16 years. In 2013, it was €1.50 ($2.04) per share, or nearly €1.9 billion total. In March, BNP announced that its *dividend payout ratio would rise to 45% over the next two years, compared to 40.9% last year. As things stand now, it is unlikely to pay out any dividends this or next year. This is bad news for the Belgian Government, which has a 10.3% stake in BNP.

*The dividend payout ratio is the percentage of a company’s net profit that is paid out to stockholders in dividends.

Earlier this year, BNP Paribas had announced that it had set aside $1.1 billion to cover the cost of impending fines in the United States. It also warned that the penalties could be much higher.

What about foreign currency dealings?

There are growing rumors that BNP may also be banned from converting foreign currencies into dollars (dollar clearing) in the US, leaving it unable to operate in international wholesale banking markets. The suspension is likely to last one year. BNP’s oil and gas financing arm, where much of the alleged illegal activity took place, will be severely affected.

BNP will probably have to ask some rival banks to handle its dollar-clearing functions during the suspension period.

If the settlement is as high as $8.9 billion, it will be the largest penalty so far this year and the biggest for doing business with rogue states, far outstripping HSBC’s $1.9 billion fine in 2012. In May, Credit Suisse agreed on a $2.6 billion settlement regarding accusations of helping Americans dodge taxes.

US regulators first heard about BNP’s alleged misconduct when an informant approached Cyrus R. Vance Jr., the Manhattan District Attorney, in 2007. The French multinational then carried out its own investigation.

Monday plea announcement expected

US authorities are hoping to announce the plea settlement on Monday. The announcement will include a statement on how BNP concealed the names of Sudanese customers when it processed transactions in the US, the New York Times quotes people familiar with the case who wished to remain anonymous.

The New York Times’ same informants said that while most of the crimes occurred between 2002 and 2009, there was also misconduct that carried on into 2012, while US authorities were carrying out their investigations.

The Financial Times cites unnamed people, who claim to be familiar with the matter, who say that the US Department of Justice sought a heftier penalty for BNP compared to other banks because in this case the volumes of transactions were far greater.

Political pleas and threats

Earlier this month, France’s Finance Minister Michel Sapin attempted to persuade US authorities to reduce the size of the fine. Mr. Sapin said after talks that he had been making progress, and added the uncertainty was not good for the French economy.

The Governor of the Bank of France, Christian Noyer, said BNP’s inability to clear dollar trades would have a detrimental effect on markets and would undermine lending at a crucial time for European banks, which are trying to pump more liquidity into the economy.

Michel Barnier, European Union Commissioner for financial services, announced publicly that BNP should be treated fairly.

Even François Hollande, the French President intervened. He wrote to President Barack Obama earlier this year asking that the penalties not be “unfair and disproportionate.”

Threats – President Hollande, along with several French lawmakers said a hefty fine could jeopardize the progress of the free trade agreement between the European Union and the United States.

Arnaud Montebourg, France’s Economics Minister, argued that if these giant fines can offer some advantages in economic warfare, “… maybe we should imitate them.”

Other European banks nervously await their fate.

The US has levied larger and larger fines on European financial institutions, adding to the perception among lenders and lawmakers that the United States has it in for them. Not only have there been fines for sanctions-violations, but also for manipulating interest rates and assisting tax dodgers.

Giant fines have also been levied on US banks by the American authorities, such as JP Morgan’s $13 billion settlement in 2013 and the $9.5 billion that Bank of America agreed to pay to Fannie Mae and Freddie Mac.

Closer regulatory scrutiny and the threat of gigantic fines have made some European financial institutions wonder whether they should reconsider their US growth plans. The Wall Street Journal quotes a senior executive of a large European bank, who said “It becomes a much more risky place from a regulatory point of view to do business.”

Among the advanced economies, the US has the highest corporate taxes. When considering the high tax burden plus stiffer regulations and penalty threats, other parts of the world start becoming more appealing.

Could it have been worse?

Yes, it most definitely could have been much worse for BNP. The fine is huge, and halting its dollar-clearing operations for a while is not nice – but BNP will survive.

A dollar-clearing punishment is a much better option for the French bank compared to losing its New York license, which would have been the kiss of death for virtually all of its US operations.

The sheer size of BNP’s fine has made some other European banks shudder. Crédit Agricole, Deutsche Bank and UniCredit are also seeking to resolve accusations of doing business with rogue nations.