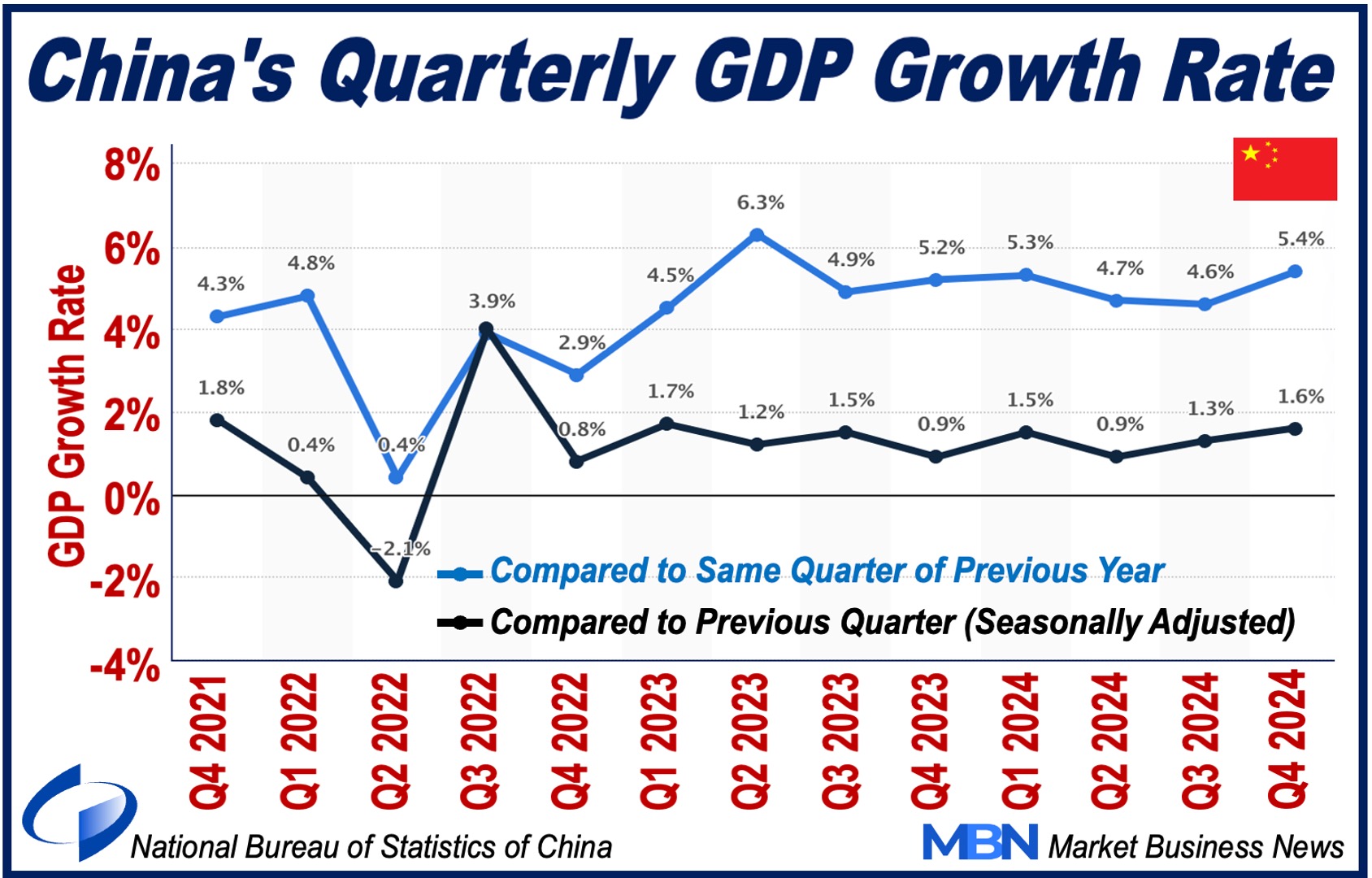

China’s GDP growth of 5% met the government’s target for 2024, despite some internal hurdles and economic headwinds.

While industrial output and exports grew robustly, domestic consumption was weak. Experts warn that this imbalance could intensify this year as demographic challenges deepen and external trade tensions rise.

Mixed Economic Signals in 2024

According to China’s National Bureau of Statistics (NBS), the country’s GDP growth accelerated during the last quarter of 2024, expanding at a year-on-year rate of 5.4%. It was mainly driven by export and production surges.

Retail sales, however, a key indicator of consumer confidence, expanded by only 3.5% in 2024, reflecting subdued or weaker domestic demand.

Beijing’s stimulus measures, which included major investments in infrastructure and interest rate cuts, have primarily benefited the export and manufacturing sectors.

China’s current imbalance underscores the difficulties in transitioning from an export-reliant economy to one fueled by domestic consumption. The economies of the US, UK, and other high-income countries are fueled primarily by domestic consumption.

Challenges Clouding the 2025 Outlook

China may face some major headwinds in 2025. The return of U.S. President Donald Trump and his threats of higher tariffs on Chinese goods could dampen export growth.

China’s current property market slump and local government debt problems place additional pressure on Beijing to stimulate domestic demand effectively.

Moreover, producer prices have remained in deflationary territory for over two years, and consumer prices showed minimal growth in 2024. Falling prices and weak consumption are bad for companies’ profits as well as household income growth, which further erodes consumer confidence.

Demographic Concerns and Workforce Contraction

China is experiencing a growing and potentially serious demographic problem. Its population is shrinking. In 2024, it shrank for the third year in a row. Despite a slight increase in the birth rate, deaths still outpace births.

The number of working-age Chinese citizens continues to decline, while people aged 65 or more now account for 22% of the total.

This aging population and shrinking workforce threaten long-term economic growth and social stability.

Funding pensions, healthcare, and other services from a shrinking active population is going to become increasingly more difficult. The government will probably have to divert funds from other economic priorities.

Calls for Policy Reforms

Economists argue that while Beijing’s stimulus measures have provided temporary relief, sustainable growth will require deeper reforms. These include:

-

Reviving Consumer Confidence

Policymakers must address the root causes of weak consumer spending, such as income insecurity, high housing costs, rising unemployment, demographic challenges (e.g., aging population and declining workforce), and the lingering effects of the COVID-19 pandemic on household savings and confidence.

-

Resolving the Property Crisis

To restore household wealth and boost confidence, the property market must stabilize.

-

Enhancing Social Welfare

Improving social safety nets and reducing inequality could encourage higher spending and economic participation.

What Lies Ahead?

China hit its 2024 GDP growth target, which is encouraging. However, the country’s challenges underline the fragility of its current economic recovery.

Industrial and export-driven growth has provided a buffer. However, without stronger domestic demand, the recovery is unsustainable – it is unlikely to last.

The government’s ability to navigate trade tensions, enact meaningful reforms, and rebuild consumer trust will determine whether it can maintain stability in 2025 and beyond.

China has the potential to become a more balanced and resilient economy if its policymakers address these structural issues head-on. A resilient economy is one that is capable of weathering both domestic and global uncertainties.