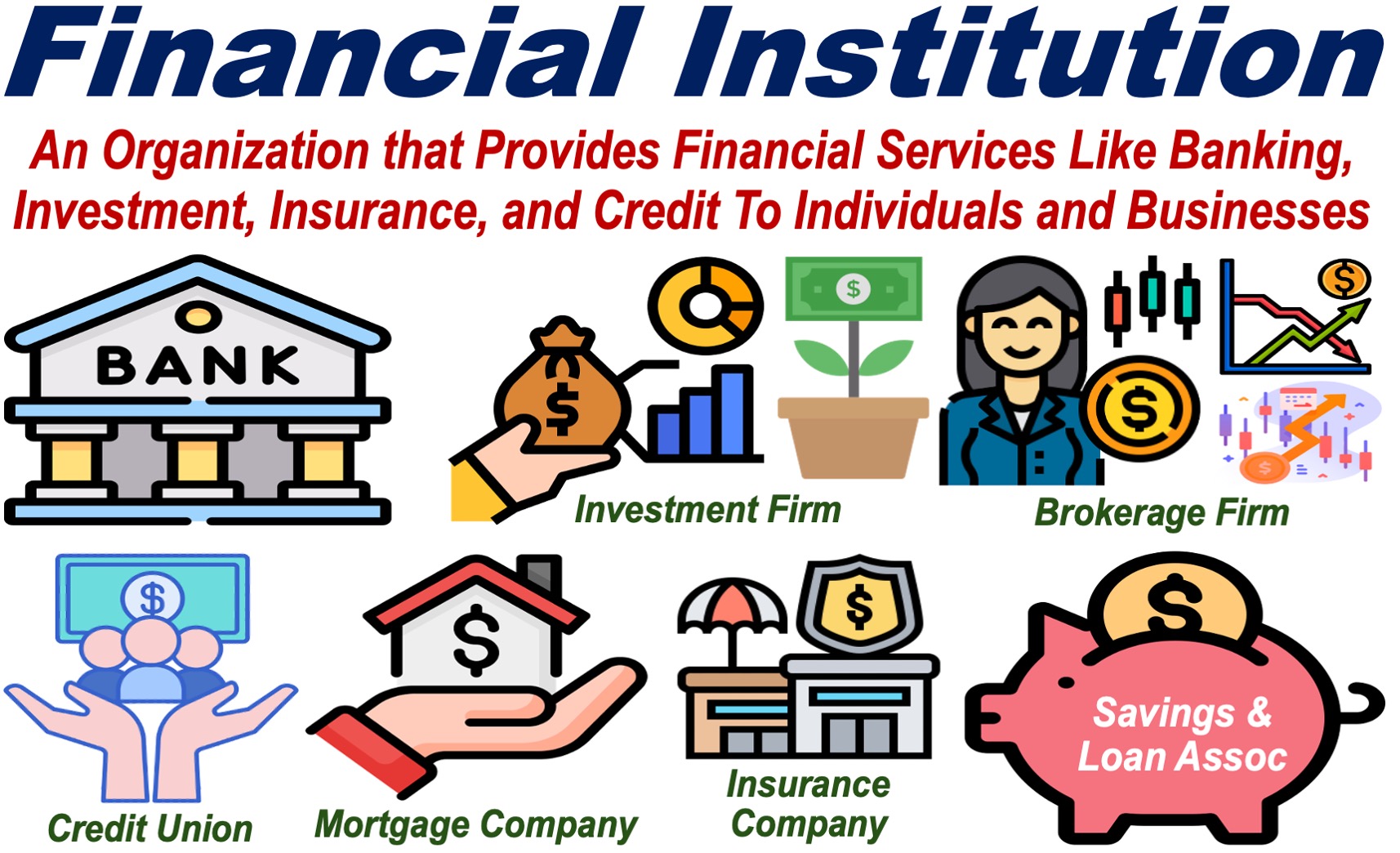

Do you work in a bank, credit union, investment firm, insurance company, or brokerage firm? If so, you work for a Financial Institution.

A financial institution is an organization that provides financial services to individuals, businesses, and other organizations.

These services can range from managing money, facilitating investments, providing insurance, giving financial advice, to extending credit and loans.

Financial institutions play a crucial role in the economy. They act as as intermediaries between savers and borrowers, facilitating the flow of money and helping you manage your financial needs.

Shiksha.com has the following definition of financial institution:

“A financial institution is an establishment that conducts financial transactions such as investments, loans, and deposits.”

“It plays a crucial role in the economy by channeling funds from savers to borrowers, facilitating the efficient allocation of resources, and supporting economic growth and development. Financial institutions include banks, credit unions, insurance companies, and investment firms.”

Types of Financial Institutions

There are several types of financial institutions, each with its own set of services. The most common types include:

Banks are perhaps the most familiar type of financial institution. They offer a wide range of services, including savings and checking accounts, loans, mortgages, and credit cards.

Banks are essential for everyday financial transactions and help you manage your money efficiently.

Most people and businesses today have a bank account. A couple of centuries ago, workers were typically paid in cash at the end of each week. Today, most employees are paid monthly by bank transfer.

- World’s Largest Banks

The four largest banks in the world are all Chinese:

- Industrial and Commercial Bank of China (ICBC). 2. China Construction Bank. 3. Agricultural Bank of China. 4. Bank of China. They are all based in Beijing.

The five largest banks outside China are:

- JPMorgan Chase & Co.

Based in: New York, United States - Bank of America

Based in: Charlotte, North Carolina, United States - BNP Paribas

Based in: Paris, France - Mitsubishi UFJ Financial Group (MUFG)

Based in: Tokyo, Japan - HSBC Holdings

Based in: London, United Kingdom - Barclays

Based in: London, United Kingdom

Insurance Companies provide financial protection against risks such as accidents, illness, or death. By paying premiums, you transfer the financial burden of potential losses to the insurance company, ensuring that you and your loved ones are financially secure in difficult times.

There are literally hundreds of different types of insurance policies. For example, companies can insure their payroll, meaning they can protect against the risk of being unable to pay wages to workers.

- World’s Largest Insurance Companies

The ten largest insurance companies in the world are (2024):

- Ping An Insurance

Based in: Shenzhen, China - Allianz

Based in: Munich, Germany - AXA

Based in: Paris, France - China Life Insurance

Based in: Beijing, China - Berkshire Hathaway

Based in: Omaha, Nebraska, United States - Japan Post Insurance

Based in: Tokyo, Japan - MetLife

Based in: New York, United States - Prudential Financial

Based in: Newark, New Jersey, United States - Zurich Insurance Group

Based in: Zurich, Switzerland - Generali Group

Based in: Trieste, Italy

Investment Firms help you grow your wealth by offering services like portfolio management, investment advice, and retirement planning.

These institutions specialize in managing investments, such as stocks, bonds, and mutual funds, to help you achieve your financial goals.

- World’s Largest Investment Firms

The ten largest investment firms in the world are:

- BlackRock

Based in: New York, United States - Vanguard Group

Based in: Malvern, Pennsylvania, United States - Fidelity Investments

Based in: Boston, Massachusetts, United States - State Street Global Advisors

Based in: Boston, Massachusetts, United States - J.P. Morgan Asset Management

Based in: New York, United States - Goldman Sachs Asset Management

Based in: New York, United States - Allianz Global Investors

Based in: Munich, Germany - BNY Mellon Investment Management

Based in: New York, United States - Amundi

Based in: Paris, France - PIMCO (Pacific Investment Management Company)

Based in: Newport Beach, California, United States

Brokerage Firms act as intermediaries between buyers and sellers of securities like stocks and bonds.

They provide you with the platform and tools needed to invest in financial markets, allowing you to trade in assets with ease. The term ‘trade,’ in this context, means ‘buy and sell.’

Credit Unions are similar to banks but are typically member-owned and operate on a not-for-profit basis. They are financial cooperatives.

They offer many of the same services as banks, such as savings accounts, loans, and credit cards, often with better interest rates and lower fees. As a member, you are part-owner of the credit union, which means profits are often returned to you in the form of better services.

-

Mortgage Companies

Mortgage Companies specialize in providing loans for purchasing real estate. They offer different types of mortgages to suit various financial situations, helping you finance your home or property purchase.

These institutions play a crucial role in the housing market, enabling you to spread the cost of buying a home over a longer period.

-

Savings and Loan Associations

Savings and Loan Associations (Building Societies in the UK) focus on accepting savings deposits and making mortgage loans. They operate similarly to banks but traditionally have emphasized home loans.

By saving with a savings and loan association, you contribute to a pool of funds that can be lent out to others, helping to finance home purchases within the community.

The Role of Financial Institutions

Financial institutions are vital to the functioning of the economy. They help allocate resources efficiently, provide credit to those in need, and offer services that enable you to save and invest. By doing so, they contribute to economic stability and growth.

These institutions also play a key role in ensuring that the financial system operates smoothly. They manage risks, provide liquidity, and facilitate transactions, making it easier for you to navigate the financial landscape.

-

Bailouts

Governments across the world recognize financial institutions as crucial for the economic well-being of their countries. That is why, during recessions, they usually *bail out major banks that are about to go bankrupt.

During the 2008 Global Financial Crisis and the Great Recession that followed, the world’s advanced economies spent hundreds of billions of dollars *bailing out financial institutions to stabilize the financial system.

* To Bail Out a company means to provide money to save it from going bankrupt. In other words, a bailout is the act of saving a company financially.

Final Thoughts

Let’s recap. Financial institutions, including banks, credit unions, investment firms, insurance companies, and brokerage firms, are vital to the economy. They help you manage money, offer credit, provide investment opportunities, and protect against financial risks.

Understanding the services they offer enables you to make informed decisions, whether you’re saving for the future, investing, or seeking financial protection.

These institutions can help you achieve your financial goals on both a personal and business level if you use them wisely.