Fiscal policy is the use of public spending and taxation to impact the economy. Public spending means government spending. National governments use fiscal policy to encourage strong and **sustainable growth. In other words, to achieve full employment and reduce poverty.

** Sustainable growth is growth that can continue over the long-term. In other words, no serious problems that can damage the economy will emerge.

The aims of fiscal policy have gained prominence since the 2007 global financial crisis. Governments stepped in to support financial systems, stimulate growth, and minimize the impact of the crisis on vulnerable groups.

The prominence of fiscal policy as a policy tool historically has fluctuated. Up to 1929, a laissez-faire approach – minimal government intervention – dominated North America’s and Western Europe’s economic scene.

The adjective ‘fiscal‘ refers to anything to do with government taxes, spending, and debts. A ‘fiscal problem,’ therefore, is a ‘government finance problem.’

People who believe that fiscal policies are crucial for economic regulation are ‘fiscalists‘.

Fiscal stimulus

Governments can try to boost the economy by either increasing public spending or reducing taxes. These two measures come under the umbrella term ‘fiscal stimulus.’

The Wall Street Crash of 1929 and the subsequent Great Depression dramatically changed how leaders and governments intervened in their nations’ economies. In fact, in the United States and the United Kingdom, the change was dramatic.

In the 1930s, policymakers pushed for governments to do more to kick-start the economy.

During the 1980s, governments across the world scaled back the size and function of governments. In that decade, markets started taking on an enhanced role in the allocation of goods and services.

Since the 2007-2008 global financial crisis, a more fiscal policy was back in fashion. In other words, government intervention returned.

How does fiscal policy work?

When politicians influence the economy, they have two main tools at their disposal; fiscal policy and monetary policy.

Monetary Policy

Monetary policy is the main focus of a nation’s central bank. It involves regulating interest rates, i.e., effectively regulating the cost of borrowing, and the money supply.

The US Federal Reserve, the Bank of England, and other central banks manage monetary policy. They do so to control inflation and stabilize their currency.

Put simply; they use monetary policy to ensure that the economy is following the right path.

Fiscal Policy

Fiscal policy refers to government spending policies that impact macroeconomic conditions. Governments carry out policy through public spending. Government borrowing and the collection of taxes also form part of fiscal policies.

Effective fiscal policy requires careful calibration to avoid overheating the economy or triggering inflationary pressures.

Through fiscal policy, governments attempt to bring down unemployment, stabilize business cycles, and influence interest rates. Additionally, in times of recession, they adjust their policy to kick-start the economy.

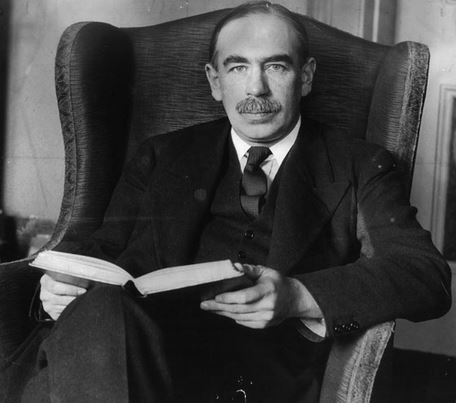

Fiscal policy changed considerably when John Maynard Keynes, (1883-1946), an English economist, came onto the scene. He fundamentally changed the theory and practice of macroeconomics and the economic policies of governments.

Keynes believed that the government could change economic performance by adjusting tax rates and government spending. His ideas are the basis for the school of thought we call Keynesian Economics.

According to Keynes, when the government alters the levels of taxation and government spending, it influences aggregate demand. This subsequently changes the level of economic activity.

Keynes said we could use fiscal policy to stabilize the economy over the course of the business cycle. Put simply; he believed it could prevent the undesirable boom-and-bust economic cycle.

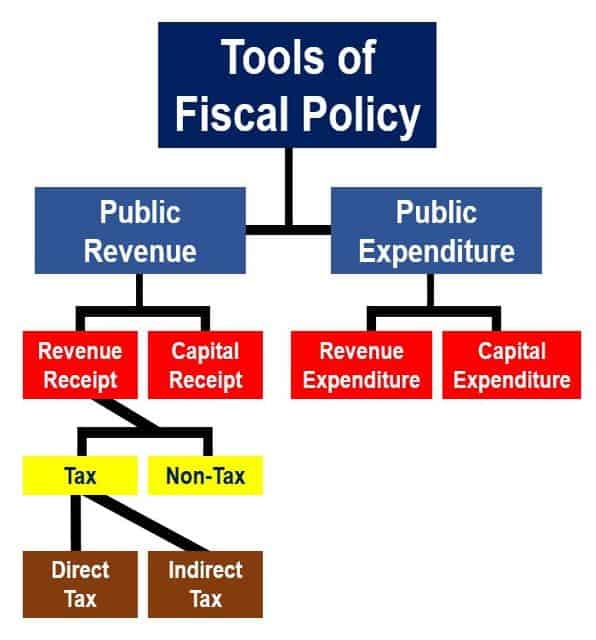

Instruments of fiscal policy

The two main instruments of fiscal policy are:

- First, changes in the level and composition of taxation,

- Second, changes in government spending.

These two policy instruments can affect the following variables in an economy:

- Aggregate demand and economic activity levels.

- The distribution of income.

- Savings and investment in the economy.

According to the International Monetary Fund:

“Governments directly and indirectly influence the way resources are used in the economy. The basic equation of national income accounting helps show how this happens: GDP = C + I + G + NX.”

Fiscal policy stances

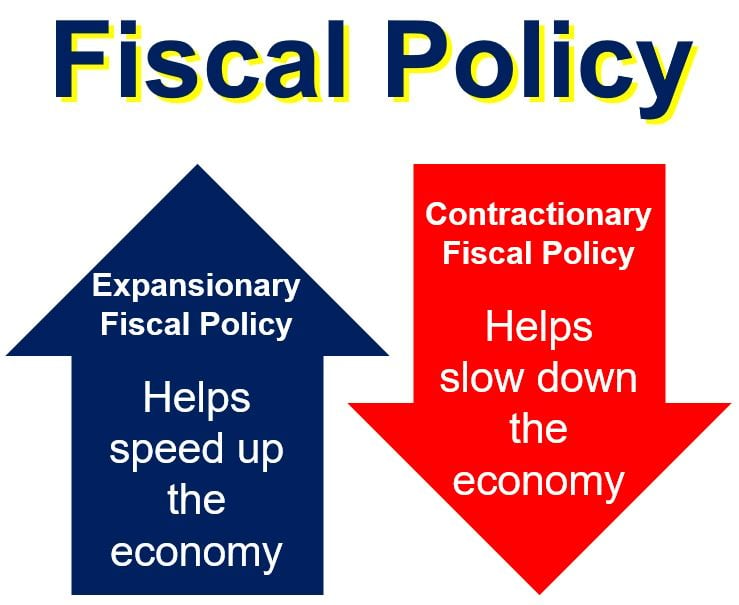

There are three main stances of fiscal policy – neutral, expansionary, and contractionary.

Neutral Fiscal Policy

Governments follow this policy when the nation’s economy is in equilibrium. In other words, tax revenue completely funds government spending.

Governments also adopt this policy when the budget outcome has a neutral effect on economic activity levels.

Expansionary Fiscal Policy

This is when the government spends more than it collects from taxation. Governments adopt this approach when the economy is in recession. We also call it a reflationary fiscal policy.

Contractionary Fiscal Policy

Governments take this approach when their expenditure is lower than their tax revenue. They aim to pay off government debt.

Even if spending or tax laws stay the same, cyclic fluctuations in the economy may cause tax revenues to go up or down.

This will subsequently affect some types of government spending, which in turn can alter the deficit situation. We do not consider these factors to be policy changes.

How to fund fiscal policy

Government expenditure can be funded in several different ways:

- Taxation.

- The benefit from printing money (Seigniorage).

- Borrowing money by issuing securities, government bonds, and bills. Less creditworthy nations might borrow directly from the World Bank or other international financial institutions.

- Consumption of fiscal reserves, i.e., dipping into its savings.

- Selling assets, such as land or floating government-owned companies. Left-leaning parties often refer to this as ‘selling the family silver.’

Keynesian economics suggests that greater government spending, accompanied by lower tax rates, are the best ways to boost aggregate demand.

When the economic boom starts, we must subsequently reduce spending and raise taxes.

Keynesian economists say we should use this approach when there is low economic activity. We can also use it during a recession. The aim is to achieve full employment and build the framework for strong economic growth, they say.

In theory, the resulting debt build-up would be paid for when the economy expands and government income increases.

Republicans in the USA and Conservatives in the UK dislike Keynesian policies. They say that all they achieve are high debts plus no growth.

Keynesian policies go against right-of-center parties’ policies of discouraging government interference in the economy.

According to lexicon.ft.com, fiscal policy is:

“A government’s policy regarding taxation and public spending.”

There is a method to determine whether current fiscal policies might overburden future generations of taxpayers. We call it generational accounting.

Fiscal drag

Sometimes, fiscal policy may be deflationary unintentionally, as occurs with ‘fiscal drag.’

Fiscal drag occurs when earnings growth and rising prices push more earners into higher tax brackets. This happens in a progressive tax system.

If their tax burdens are greater, their spending declines, i.e., there is fiscal drag.

Fiscal Policy – vocabulary and concepts

There are many terms in economics/financial English related to “fiscal policy.” Lets have a look at some of the, their meanings, and how we can use them in a sentence:

-

Fiscal Policy Advisor

A financial expert specializing in government revenue and expenditure strategies.

Example: “The government’s fiscal policy advisor recommended adjustments to tax rates to balance the budget.”

-

Fiscal Policy Committee

A group of officials or experts tasked with reviewing and guiding a government’s fiscal strategies.

Example: “The Fiscal Policy Committee meets quarterly to assess the impact of current tax laws on the economy.”

-

Fiscal Policy Reform

Changes or improvements made to the ways a government manages its spending and taxation.

Example: “The proposed fiscal policy reform aims to streamline the tax collection process and reduce deficits.”

-

Fiscal Policy Framework

The set of principles and guidelines that shape a government’s approach to managing its finances.

Example: “Under the new fiscal policy framework, the government prioritizes infrastructure investments to stimulate growth.”

Fiscal Policy Measures

Specific actions taken by a government to influence its economy through taxation and public spending.

Example: “In response to the recession, the central bank introduced several fiscal policy measures to boost consumer spending.”

-

Fiscal Policy Outlook

An analysis or forecast of future government budgetary policies and their expected economic impact.

Example: “Economists have a positive fiscal policy outlook due to the anticipated increase in government spending.”

-

Fiscal Policy Impact

The effect that changes in government taxation and spending have on the overall economy.

Example: “The fiscal policy impact on small businesses was significant, with many benefiting from the reduced tax rates.”

Video – What is Fiscal Policy?

This educational video presentation, from our sister channel on YouTube – Marketing Business Network, explains what ‘Fiscal Policy’ is using simple and easy-to-understand language and examples.