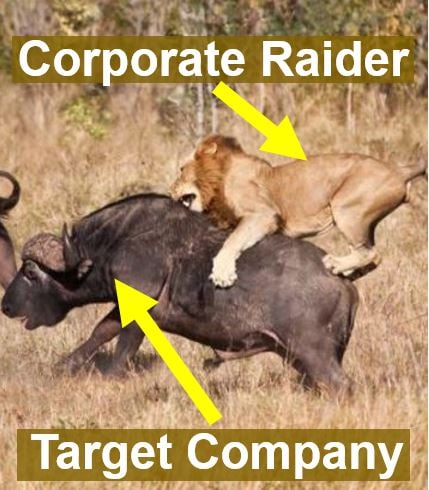

A Hostile Takeover is the acquisition of one company by another company. However, the target company, i.e., the ‘prey,’ did not want the acquisition to occur. In a hostile takeover attempt, the target company’s Board of Directors recommends against the acquisition. Subsequently, the bidder goes directly to the shareholders. The bidder may also fight to replace some of the board members. The aim is to get the new board members to approve the takeover.

Hostile takeovers can sometimes lead to unexpected innovations and restructuring that benefit the acquired company, as new management can bring fresh perspectives and strategies.

The opposite of a hostile takeover is a friendly takeover. A takeover is an acquisition of one company by another company. We can say either ‘takeover‘ or ‘acquisition.’

M&A (mergers & acquisitions) is a practice of corporate finance that deals with mergers and acquisitions to create a new enterprise. M&A also fuses companies together or helps firms complete a takeover.

Put simply; a hostile takeover is an acquisition in which the ‘prey’ tries to resist. However, the ‘predator’ keeps pushing.

Tender offer in a hostile takeover

In a hostile takeover, the bidder, we may also refer to the bidder as the corporate raider. The corporate raider still tries to go ahead with the acquisition regardless of senior management’s resistance.

When this happens, the bidder needs to make the offer attractive enough. The bidder wants the target company’s stockholders to break ranks and agree to sell their shares. We refer to an offer to shareholders in this context as a tender offer.

With a tender offer, the corporate raider is under no obligation to purchase any shares that have been put forward by stockholders. It does not need to buy them until a declared total number of stocks have been tendered.

This does away with the initial need for huge quantities of cash to purchase shares. The raider does not have to liquidate its stock position should the tender offer fall through.

Sometimes, the bidder makes a tender offer that senior management cannot refuse. We call this a godfather offer. The offer is extremely generous, i.e., the bidder offers to buy the shares at much higher than the market price.

If senior management refuses to accept a godfather offer, the shareholders might rebel. In fact, they could also initiate a suit against the directors.

Other hostile takeover tactics

Another approach in an open market is to buy up as many of the target’s shares as possible. The corporate raider does this until it has a majority interest in the stock of the company. Majority interest means more than 50% ownership of a company’s shares.

The bidder also has the option of pursuing a proxy fight. In other words, it persuades enough stockholders to replace board members with people who are more likely to approve the acquisition.

In some cases, the corporate raider may use a takeover vehicle to launch a hostile takeover. This is usually another company that the raider controls.

According to BusinessDictionary.com, the term ‘hostile takeover’ refers to:

“Acquiring a firm despite the disapproval of, or open resistance from, its board of directors. The acquirer (‘raider’) usually takes the takeover offer direct to the target firm’s stockholders (shareholders) or seeks their approval to remove the obstructing board members.”

Some target companies may adopt a kamikaze defense. In other words, they make themselves less attractive to the hostile bidder. Perhaps they raise their debt levels, sell off their best assets, or acquire undesirable assets.

A fat man strategy involves acquiring assets or other companies and taking on additional debt. The target company then appears fat and bloated.

Hostile takeover is risky

Most takeovers occur by mutual agreement, i.e., both sides agree that the acquisition or merger is a good thing. In other words, the board believes that it is in the shareholders’ interests to go ahead. We call these friendly takeovers.

When there is mutual agreement, both sides have the opportunity to evaluate the costs, benefits, assets, and liabilities. Additionally, they can complete the transaction with full knowledge of all the risks and returns.

This is not the case, however, with a hostile takeover. The target company’s management do not typically share any information that is not already available for public view.

Consequently, the acquiring company, in a hostile takeover, takes a risk. In fact, the corporate raider could end up with debts and other problems it did not know about.

Additionally, the hostile takeover may result in a mass exodus of the target company’s top management. This kind of senior management shakeup may disrupt the company’s operations considerably.

In other words, when there is mutual agreement, due diligence can be carried out thoroughly. This is often not the case with a hostile takeover.

In 2010, Sanofi S.A. a French multinational pharmaceutical company, fought hard to take over Massachusetts-based Genzyme Corporation. Sanofi had to offer more per share than it had initially wanted before triggering a top-up option. It needed to pay a lot to assume control of 90% of Genzyme. Sanofi eventually paid just over $20.1 billion and successfully acquired Genzyme.

Defense against a hostile takeover

– In the USA: target companies can use Section 16 of the Clayton Act to seek an injunction. They can argue that the acquisition of its stock would violate Section 7 of the Act.

– Poison Pill: this is a common technique that large and small companies use. It is an effective way to reduce the corporate raider’s chances of success.

Senior management adopts bylaws that entitle the original stockholders the right to purchase extra shares at a discount.

A new shareholder can trigger this right after it has acquired a certain percentage of the company’s stock. Subsequently, the poison pill increases the total number of shares. This dilutes the raider’s stock holding and makes it far too costly for it to gain a controlling interest.

- Board Member Elections: if they are staggered, proxy fights will take much longer. It is also possible to introduce bylaws that require over half of the company’s stockholders to approve new owners. This makes it easier for the original shareholders to stop any takeover attempt in its tracks.

- Golden Parachutes: if the severance packages for senior managers are extremely generous, the raider may be put off. The corporate raider is discouraged because it will find it prohibitively expensive to trim the company’s upper management.

- Greenmail: the target company’s board buys the hostile bidder’s shares. It does this at a higher price than their market value.

- White Knight: the Board may look for another company to acquire them. Senior management is more friendly with this other company. The directors also believe an acquisition by the white knight would better serve the interests of the shareholders.

- Safe Harbor: the targeted company acquires a heavily-regulated firm. Subsequently, it becomes less attractive to the predatory firm.

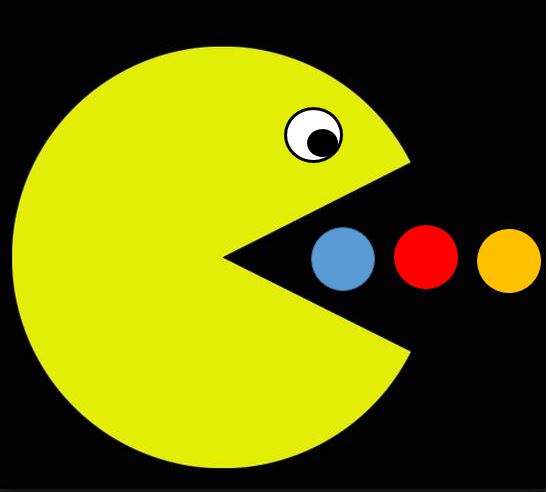

Pac-Man defense

With a Pac-Man defense tactic, the hunter suddenly becomes the prey. In other words, the two companies swap roles. The target company reacts by attempting to gain control of the corporate raider.

The target company literally ‘turns the tables.’ It also makes the bidder attractive to other corporate raiders.

In 1982, Bendix Corporation attempted a hostile takeover of Martin Marietta. Marietta, however, began purchasing Bendix stock with the aim of gaining a controlling interest.

Marietta persuaded Allied Corporation to come in as a white knight. Allied acquired Bendix that year. So Bendix, which started off as the predator, ended up being the prey.

The target company may turn the tables on the corporate raider, making the raider the target. This is the result of a Pac-Man defense tactic. The hunter turns into the prey.

SEC commissioners said in 1984 that they were very concerned about the implications of Pac-Man tactics. However, they also acknowledged that the strategy could benefit stockholders under certain circumstances. SEC stands for the US Securities and Exchange Commission.

The commissioners balked at endorsing any new regulations. However, they stressed that senior management, in resorting to a Pac-Man strategy, must prove that it was not acting solely out of a desire to stay in office.

One concern is the diversion of a significant amount of company money. It could use that money to increase profits. In fact, it could also use the money to gain control of a corporate raider.

Video – What is takeover?

This interesting video presentation, from our sister channel in YouTube – Marketing Business Network, explains what a ‘Hostile Takeover’ is using simple and easy-to-understand language and examples.