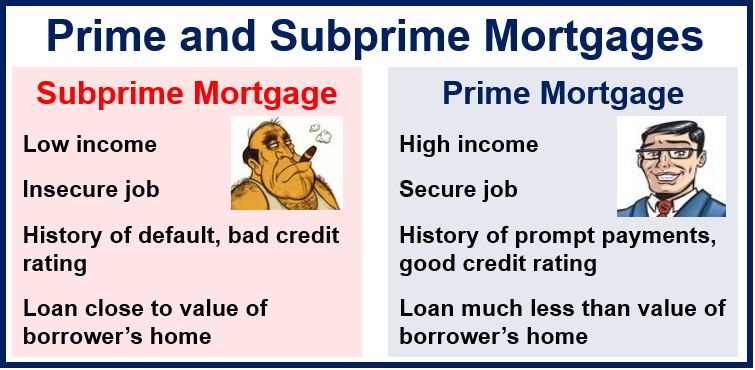

A subprime mortgage is a type of mortgage that is made out to borrowers who have a very low credit rating.

Subprime borrowers are mortgage candidates with a FICO score of less than 640. However, this definition has fluctuated over time. FICO scores, developed by a company called FICO, are the credit scores most lenders use to determine your credit risk.

There is a greater risk of loan default when lending to subprime borrowers than prime borrowers. Prime borrowers, who are seen as the most creditworthy, have a FICO score of more than 720.

Financial institutions typically charge higher interest on a subprime mortgage compared to a lower risk conventional mortgage, because of the extra risk they are carrying.

Subprime mortgages are more common when lenders know property prices will rise.

Subprime mortgages are more common when lenders know property prices will rise.

Subprime mortgages boost home ownership

Subprime mortgages are typically praised because they help increase the total number of homebuyers in a country. Minorities are over-represented in the subprime lending market.

Studies have shown that in upper-income African-American neighborhoods, a person is one-and-a-half times as likely to have a subprime loan compared to individuals in low-income white neighborhoods.

In areas where Hispanics represent 80 percent of the population, they were 1.5 times as likely to have a subprime mortgage loan than in the rest of the United States..

According to the U.S. Department of Housing and Urban Development:

- Home refinance loans account for higher shares of subprime lenders’ total origination than prime lenders’ originations.

- Subprime lenders originate a larger percentage of their total originations in predominately black census tracts than prime lenders.

Harvey S. Rosen, a professor at Princeton University said that “the main thing that innovations in the mortgage market have done over the past 30 years is to let in the excluded: the young, the discriminated-against, the people without a lot of money in the bank to use for a down payment.”

Subprime mortgages and the 2008 financial crisis

However, subprime lending has also been subject to a lot of scrutiny. Subprime mortgage delinquencies and foreclosures are thought to be one of the main causes of the 2008 financial crisis and the Great Recession that followed.

During the first eight years of this century, house prices were going up. Lenders knew that if they awarded mortgages to people with bad credit ratings, they would still get their money back because by the time they defaulted the value of their home would be worth much more than the amount the had lent.

When the 2008 financial crisis hit, house prices plunged, and lenders, awash with subprime mortgage failures, were unable to get their money back. Several major banks around the world had to be bailed out by the taxpayer.

Video – What is a Mortgage?

A mortgage is a loan that people take out when they want to buy a property.