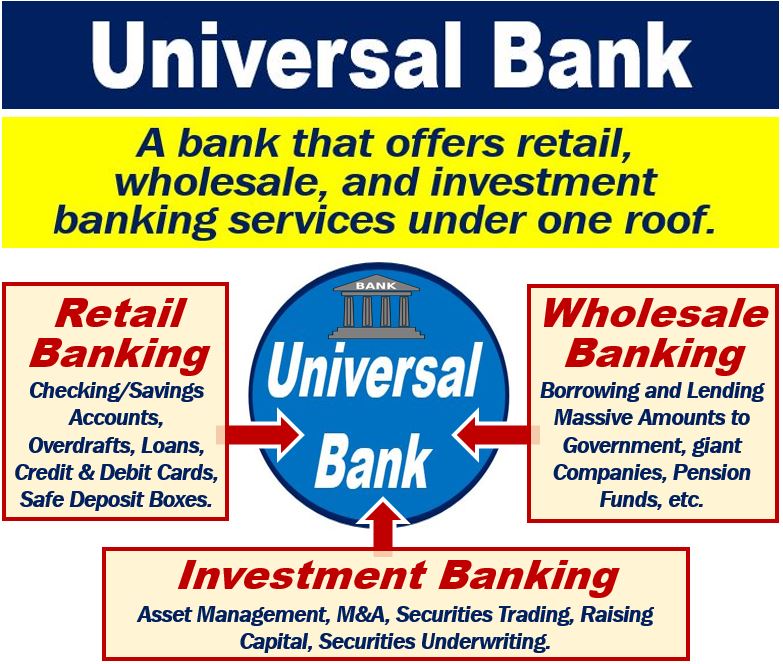

A Universal Bank is a bank that combines the three main services of banking under one roof. The three services are wholesale banking, retail banking, and investment banking. In other words, it is a retail bank, a wholesale bank, and also an investment bank. As well as being able to offer an all-encompassing service, universal banks can reap the synergies that exist when they operate in the three services simultaneously.

A universal bank, logically, offers universal banking. Universal banking is a type of financial service that combines the aspects of investment, retail, and wholesale banking.

A typical universal bank also offers other financial services such as insurance.

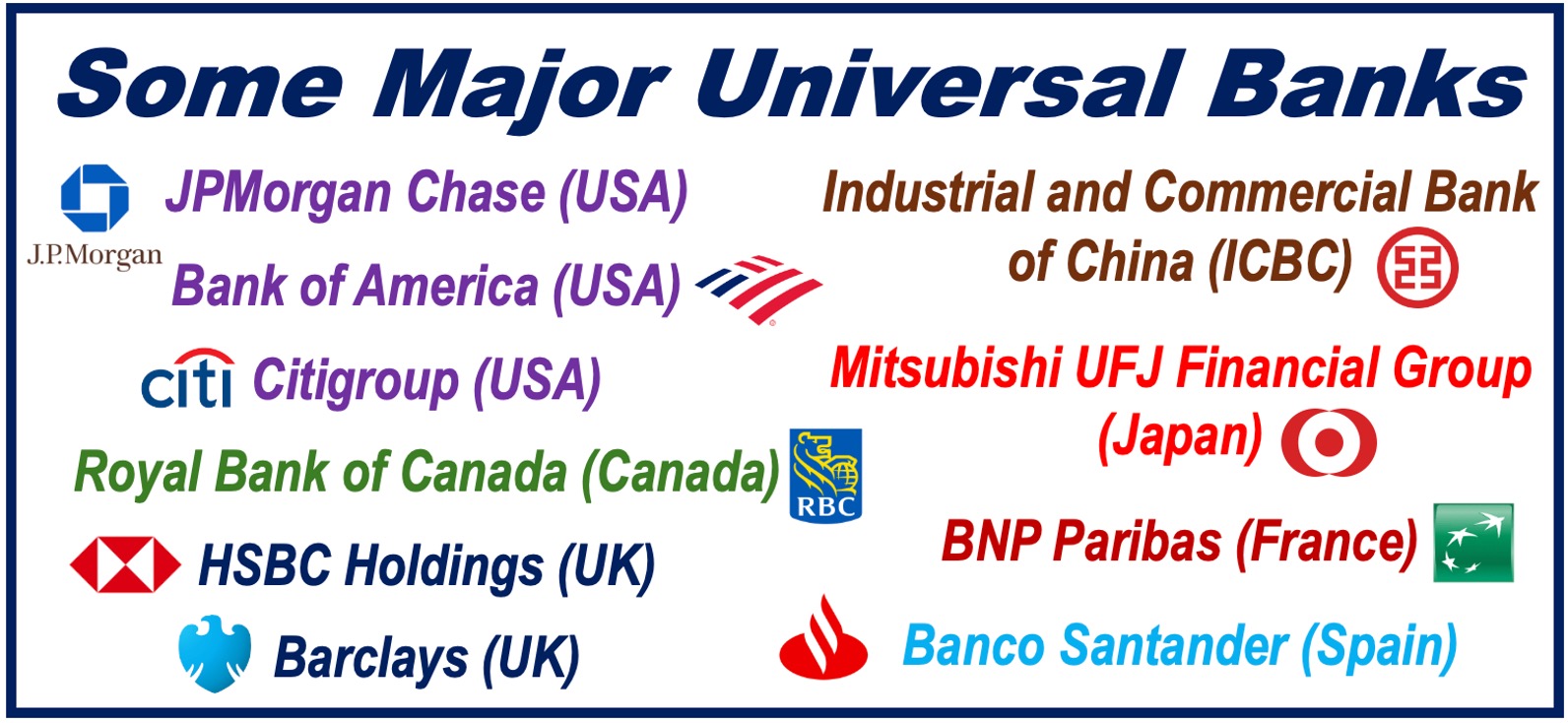

BNP Paribas, Deutsche Bank, and JP Morgan Chase, for example, are universal banks. Citigroup, Bank of America, Barclays, Banco Santander, HSBC, and Mitsubishi are also universal banks. In fact, the twenty largest banks in the world are all universal banks.

Somebody who has a checking and savings account in a universal bank can take advantage of its investment services. This is useful if customers want to open their own investment portfolio.

Universal bank services

Universal banks offer three main services:

Retail banking

Retail banking services members of the public and small and medium-size businesses. It focuses on looking after customers’ money as well as offering loans and mortgages.

Retail banking includes the following services: savings accounts, checking accounts (UK: current accounts), overdrafts, personal loans, and mortgages.

It also includes the provision of credit/debit cards, travelers’ checks, safe deposit boxes, and certificates of deposit.

Wholesale banking

Wholesale banking involves borrowing and lending money on a very large scale. Retail banks deal with relatively small amounts per customer. Wholesale banks, on the other hand, deal with massive amounts.

Wholesale banks’ customers include pension funds, giant companies, governments, and other financial institutions.

Investment banking

Investment banks focus on services for major investors and companies. They specialize, for example, in the investment requirements of pension funds.

Investment banks do not take deposits. In the UK, Ireland, and some other Commonwealth countries, people call them merchant banks.

The main activities of investment banks are asset management, M&A, raising capital, securities trading, and securities underwriting. M&A stands for Mergers and Acquisitions.

Universal bank concept

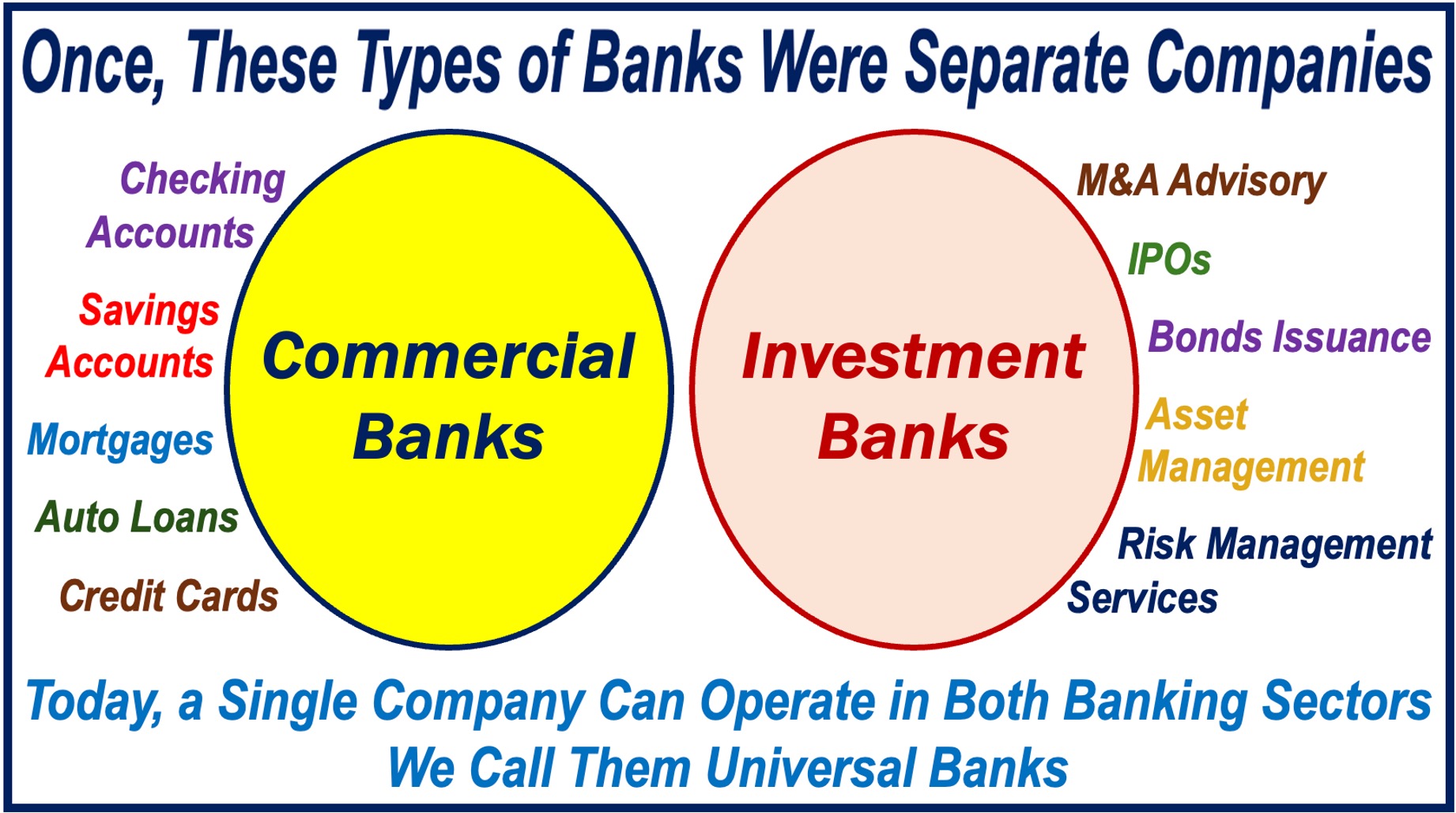

The universal bank concept is most relevant in the United States and the United Kingdom. Historically, in both countries, there has been a clear difference between commercial and investment banks. In this context, a commercial bank is a retail bank (UK: high street bank).

The Glass-Steagall Act of 1933 drew the distinction in the US.

However, the regulatory barrier to the combination of commercial and investment banks has mostly gone today. Therefore, several universal banks have emerged in both the British and American jurisdictions.

There were once many pure investment banks. However, since the Global Financial Crisis of 2007/8 and the Great Recession that followed, the banking environment has changed.

In many other countries the regulatory distinction between investment banks and commercial banks is less pronounced. As a result, very large banks typically operate as universal banks offering a broad range of services, while smaller institutions tend to specialize either as commercial banks or as investment banks.