There are growing risks to global financial stability, the Bank of England (BoE) has warned. The UK’s central bank has expressed concerns about the negative impacts of increasing trade barriers and geopolitical tensions.

When Donald Trump becomes US president in January 2025, there is global concern that he will raise tariffs (import taxes).

Geopolitical tensions are currently concentrated in the Middle East and Eastern Europe.

These developments could disrupt economic growth and trigger financial market volatility. They could also complicate central banks’ efforts to manage inflation.

Global Fragmentation and its Consequences

The BoE’s Financial Stability Report—November 2024 identifies a troubling trend: a rise in global fragmentation. Global fragmentation refers to:

- Reduced international trade and investment cooperation, including the imposition of trade barriers such as tariffs, quotas, and regulatory restrictions, which can limit cross-border business and global productivity.

- Geopolitical tensions and conflicts, which create uncertainty and disrupt global supply chains, impacting financial markets and national economies.

- Decreased policy coordination among nations, weakening collective efforts to address global challenges, such as financial stability or climate change.

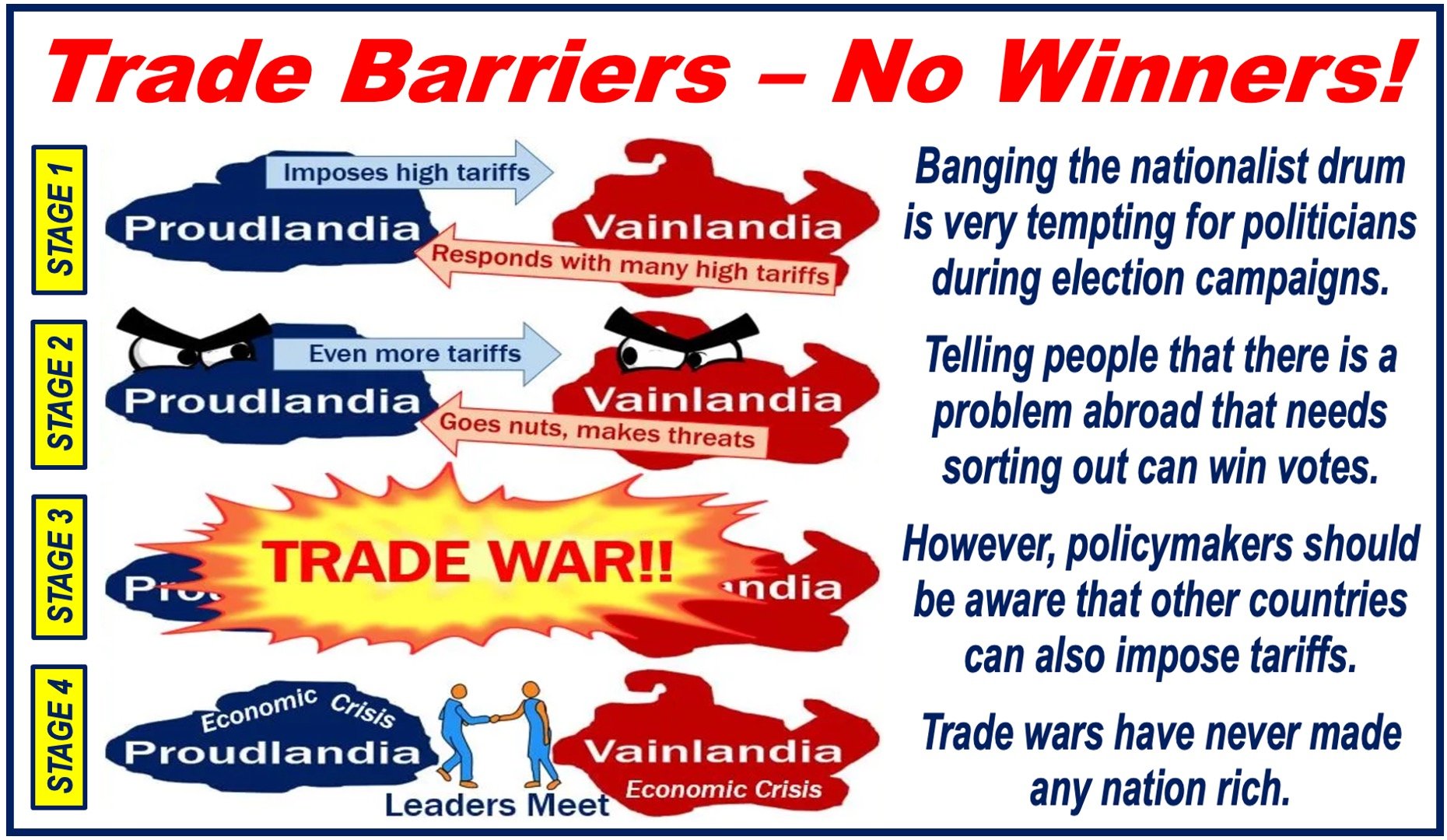

Trade Barriers Undermine Economic Stability

Reduced international cooperation on trade and policy threatens economic stability worldwide. Key risks include:

-

Economic Growth Decline

Trade barriers, including tariffs and quotas, have historically slowed GDP growth and reduced economic output, even in the countries that imposed them.

In an interview with the Financial Times, Clare Lombardelli, the Deputy Governor for Monetary Policy at the Bank of England, said,

“I don’t want to speculate on the specifics but we know barriers to trade are not a good thing, whether they are tariffs or regulatory or others.”

“Whether you are an economic historian, an economic theorist, or a data-driven economist, the impact is clear in terms of its direction. In terms of its size, that depends on the circumstances.”

-

Market Volatility

Uncertainty about trade policies might lead to abrupt changes in asset prices and higher interest rates, which increase borrowing costs.

-

Financial Resilience Challenges

Since the 2007/8 global financial crisis and Great Recession that followed, countries have worked to make their financial systems more resilient to economic shocks. Fragmentation, however, could hinder these efforts.

These issues are especially critical for open economies like the UK, Germany, Japan, and Canada, which rely heavily on international trade and a robust financial sector.

As global risks rise, maintaining stability and resilience in financial systems has become increasingly important.

The Role of Geopolitics

The term ‘geopolitics’ refers to how geographic factors influence politics, economics, and international relations, including how countries interact and compete.

Geopolitical tensions, such as the Ukraine-Russia war, strained US-China relations, and ongoing conflicts in the Middle East add another layer of complexity.

The current tensions can disrupt global trade, supply chains, scare investors, destabilize financial markets, and undermine international cooperation, which can also weaken GDP growth.

Impact of Trade Barriers on the UK Economy

As an economy deeply integrated into global markets, the UK faces unique vulnerabilities:

-

Mortgage Pressures

Over 4.4 million British households are expected to refinance at higher rates, although some may benefit from recent reductions in borrowing costs.

-

Banking Sector Health

UK banks remain well-capitalized, but non-bank financial institutions, such as hedge funds, investment firms, and pension funds, could struggle in the face of sudden market corrections.

-

Inflation and Growth Outlook

Persistent inflation and slow wage growth continue to weigh on economic recovery. These two factors make it much more difficult for the BoE to lower interest rates.

The Path Forward

“The importance of international cooperation in minimizing these risks cannot be overstated,” the BoE stressed. It outlined the following recommendations:

-

Strengthening Financial Standards – Compliance

Central banks, international financial organizations, regulatory bodies, governments, and financial institutions such as banks must adhere to global financial regulations to help build a more resilient system.

-

Strategic Stress Testing

The BoE plans to conduct detailed stress tests every two years. These tests will focus on the evolving or current risks, making them more relevant and effective.

-

Gradual Policy Adjustments

Maintaining a cautious approach to monetary policy will help address inflation and support economic stability. Monetary policy refers to the actions central banks take to control money supply, interest rates, and inflation in the economy.

Conclusion

The prospect of rising trade barriers and global fragmentation could pose significant challenges for economies across the globe.

The Bank of England’s warnings underscore the need for countries to take action together to help safeguard financial stability and ensure sustainable growth.

Business leaders and policymakers must remain vigilant and ready to adapt as these risks emerge.