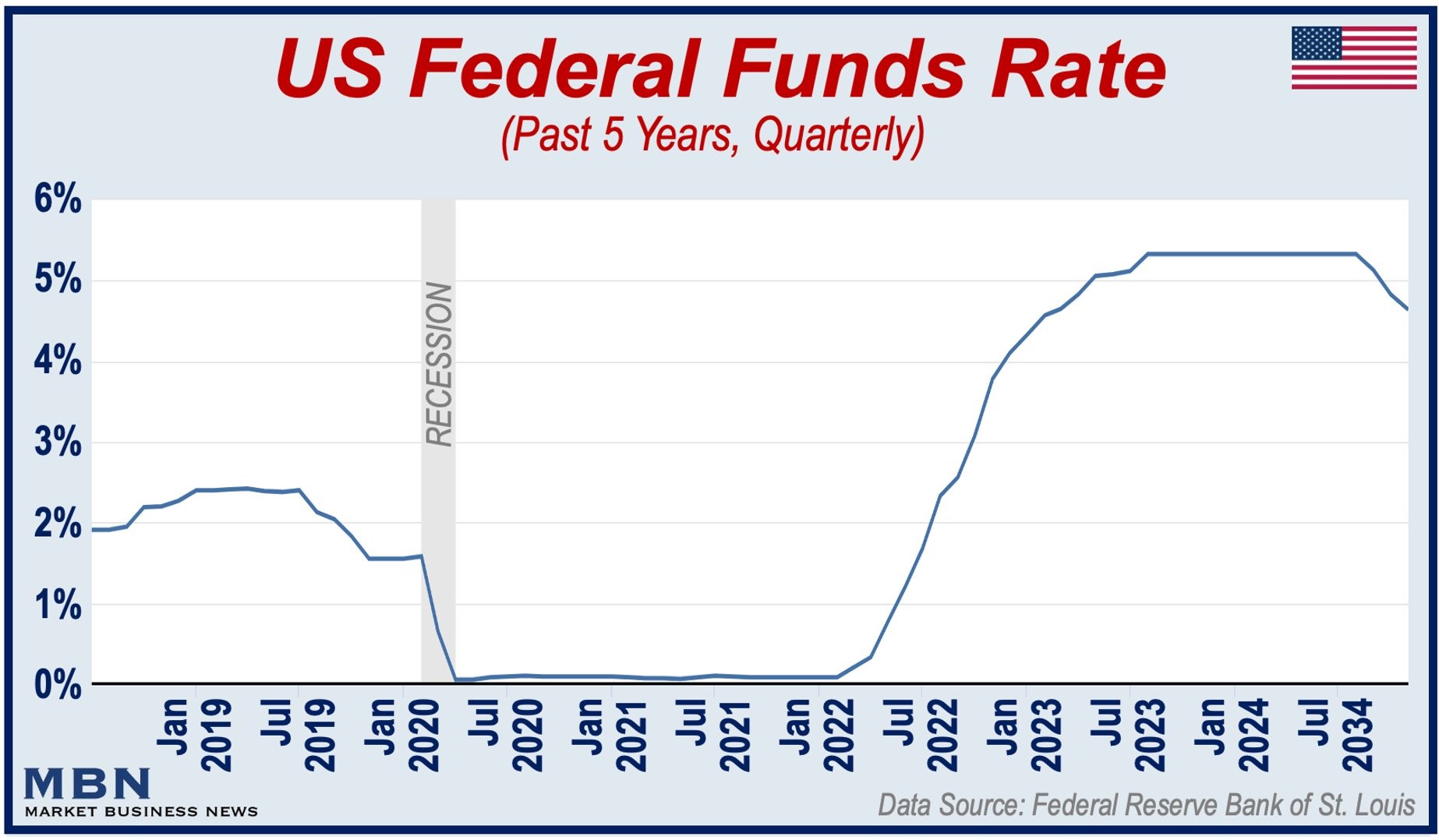

The Federal Reserve, America’s Central Bank, has cut interest rates several times so far this year. Its last cut was in December (earlier this month), when it dropped by 0.25 percentage points (25 basis points).

Since the beginning of 2024, the Federal Reserve has lowered the benchmark rate by a full percentage point – from 5.25% to 5.50% to 4.25% to 4.50% as of December 18th, 2024.

However, mortgage rates have risen, frustrating homebuyers and baffling (confusing) many observers.

Let’s take a closer look at how mortgage rates are determined and the broader context of the US economy today. It will help you understand this apparent contradiction.

Mortgage Rates Follow Bonds, Not Fed Rates

Unlike short-term interest rates, which the Federal Reserve directly controls, mortgage rates are largely influenced by the yields on 10-year U.S. Treasury notes.

Treasury notes are a type of government bond, which the U.S. uses to borrow money from investors. In return, the government commits to repaying the loan amount, along with interest, over a set period.

Treasury yields often reflect what investors anticipate for inflation, economic growth, and monetary policy. When these yields increase, mortgage rates usually go up as well.

For example, in December, the 30-year fixed mortgage rate jumped to 6.72%, compared to 6.60% just a week earlier—even though the Federal Reserve had recently cut rates. This rise was tied to changes in the bond market, driven by higher inflation expectations and growing uncertainty in the economy.

Why the Bond Market Is Nervous

Several factors have contributed to volatility in the bond market:

-

Concerns About Inflation

The US annual inflation rate is currently at 2.75%, compared to 2.60% last month and 3.14% last year. Although it is moving in the right direction, it is still above the Federal Reserve’s target of 2%. Most central banks globally aim for 2% annual inflation.

Many investors worry that it will be difficult to bring it fully under control, particularly since the economy continues to grow at a strong pace.

-

Fiscal and Economic Policies

Government policies, such as tariffs, tax cuts, and tighter immigration rules, can push the inflation rate further upwards.

At the same time, rising federal debt and growing budget deficits have made investors increasingly cautious, which has placed upward pressure on bond yields.

-

Uncertainty About the Fed’s Next Steps

The Federal Reserve Chair Jerome Powell has recently stated that there will likely be fewer rate cuts than expected in 2025. His statement has unsettled the market.

Why Mortgage Rates Are Higher Than Treasury Yields

Mortgage rates tend to follow the same general direction as Treasury yields, but they come with an added “spread” to account for higher levels of risk. This is because mortgages carry more risk compared to government bonds for several reasons:

-

Default Risk

Homeowners may miss payments or default, making mortgages less secure than US Treasury bonds. To default means to fail to pay back a debt.

-

Prepayment Risk

Homeowners can refinance or pay off their loans early, which may disrupt the expected cash flow for investors.

When mortgage rates are high (as they are now), these risks are more pronounced. To compensate for this, investors require higher returns, which has widened the gap between Treasury yields and mortgage rates.

Challenges for Homebuyers

Many Americans who want to buy their first home may be unable to do so now because of rising mortgage rates. When the mortgage rate goes up, so do monthly installments (repayments).

In a USA Today article, writer Andrea Riquier quotes Jill Comfort, a real estate broker in Arizona, who said the following about first-time buyers, “High interest rates are just making their payments go way higher. A lot of people are opting to wait.”

Both buyers and sellers often find this unpredictability frustrating. A sudden rise or drop in rates can mean that one day you’re a serious contender in the housing market, and the next, you’re priced out.

Looking Ahead

Economic and market uncertainty doesn’t appear to be letting up anytime soon. Experts warn that factors like inflation, rising government debt, and strong economic growth could keep mortgage rates high for the foreseeable future.

As Jessica Lautz of the National Association of Realtors explained, “The market is just responding to the tone of the Fed’s message.”

If you are navigating today’s housing market in the United States, you need to have an abundance of patience and careful financial planning.

Although the Federal Reserve’s moves suggest that borrowing costs could ease in the long run, the gap between short-term rate cuts and rising mortgage rates underscores just how complex the broader economic system can be.